Cette page a été archivée

L'information dont il est indiqué qu'elle est archivée est fournie à des fins de référence, de recherche ou de tenue de documents. Elle n'est pas assujettie aux normes Web du gouvernement du Canada et elle n'a pas été modifiée ou mise à jour depuis son archivage. Pour obtenir cette information dans un autre format, veuillez communiquer avec nous.

Sur cette page

- Sommaire

- Objet et méthode de la consultation

- Résultats

- Thèmes principaux

- Renseignements démographiques sur les participants

- Prochaines étapes

- Merci

- Des commentaires sur ce rapport

Ce que nous avons entendu : Consultation publique sur l'encadrement de la compétitivité et de l'innovation en vue de la réussite

Téléchargez le rapport complet

(PDF format, 2470 ko, 33 pages)

Publié mars 2022

Sommaire

Ayant pour mandat de protéger les aliments, les animaux et les végétaux et de soutenir le commerce international et l'accès aux marchés, l'Agence canadienne d'inspection des aliments (ACIA) joue un rôle essentiel pour faciliter la compétitivité, l'innovation et la croissance économique inclusive dans le secteur agricole et agroalimentaire.

Selon la rétroaction obtenue des telles que les Tables de stratégies économiques de 2018, la Feuille de route pour l'examen réglementaire dans le secteur de l'agroalimentaire et l'aquaculture de 2019, et le rapport 2020 du Comité sénatorial permanent de l'agriculture et des forêts intitulé Fabriqué au Canada : Faire croître le secteur alimentaire à valeur ajoutée au Canada, les intervenants ont exprimé la nécessité pour l'ACIA et d'autres ministères de tenir compte des incidences des règlements et des décisions réglementaires sur la compétitivité et l'innovation du secteur.

En outre, les nouveaux défis de la pandémie de COVID-19 nous ont encore démontré qu'une réglementation plus souple et plus agile pourrait jouer pour faciliter le commerce interprovincial et aider à promouvoir la relance économique dans le secteur, tout en renforçant la résilience et en améliorant la préparation pour l'avenir.

Dans ce contexte, l'ACIA a tenu une consultation publique de 60 jours, du 18 janvier 2021 au 19 mars 2021 sur l'encadrement de la compétitivité et de l'innovation en vue de la réussite pour examiner ce qui pourrait être fait pour renforcer davantage ses règlements, programmes et services afin de favoriser la compétitivité et l'innovation dans le secteur agricole et agroalimentaire.

Ce rapport présente les 5 domaines thématiques que les intervenants ont cernés pour les investissements futurs de l'agence.

- Harmonisation à l'échelle internationale : Améliorer l'harmonisation des règlements et des programmes pour faciliter l'accès aux marchés et aider les innovateurs à faire bonne figure à l'échelle mondiale.

- Coordination nationale : Travailler avec tous les ordres de gouvernement pour éliminer les barrières commerciales interprovinciales et atteindre l'équivalence nationale, utiliser une approche pangouvernementale en matière de réglementation ainsi que promouvoir et protéger la marque canadienne.

- Prestation de programmes et de services : Réduire les délais administratifs, numériser les services, collaborer avec des tiers de confiance pour l'exécution des programmes et vérifier la conformité et appliquer la loi selon une approche claire et cohérente.

- Exigences préalables à la mise en marché et approbations pour les produits nouveau : Clarifier et rationaliser les exigences réglementaires préalables à la mise sur le marché, et établir un ordre de priorité pour les approbations de produits nouveaux au Canada.

- Programmes adaptés aux petites et moyennes entreprises et aux entreprises autochtones : Soutenir les petites et moyennes entreprises (PME) du Canada et concevoir des méthodes culturellement compétentes pour faire avancer la réconciliation et soutenir les entreprises autochtones.

Objet et méthode de la consultation

Objectif

- Examiner les meilleurs moyens de positionner les programmes, les services et les règlements de l'ACIA pour soutenir la relance économique et améliorer la résilience du secteur agricole et agroalimentaire.

Pour atteindre cet objectif, l'ACIA a posé aux intervenants les 4 questions suivantes.

- Selon vous, dans quels domaines l'Agence canadienne d'inspection des aliments (ACIA) doit-elle le plus examiner l'impact économique cumulatif des exigences réglementaires supplémentaires sur le secteur agricole et agroalimentaire?

- Selon vous, dans quels domaines l'ACIA pourrait-elle le mieux aider le secteur agricole et agroalimentaire à accéder aux marchés?

- Dans quelle mesure êtes-vous favorable à la priorisation des activités réglementaires visant à faciliter l'accès aux marchés des produits nouveaux, compte tenu du mandat de l'ACIA et de la nécessité de promouvoir des règles du jeu équitables pour les parties réglementées?

- Selon vous, comment l'ACIA se positionne-t-elle pour soutenir les petites et moyennes entreprises (PME) et les peuples autochtones exerçant des activités agricoles?

Les personnes que nous avons consulté

- Associations industrielles

- Associations de consommateurs

- Entreprises du secteur agricole et agroalimentaire, y compris les PME et les entreprises exploitées par divers groupes de population

- Membres du grand public

- Autres ordres de gouvernement

- Milieu universitaire

- Organisations non gouvernementales (ONG)

Ce que nous avons fait

L'ACIA a communiqué avec environ 3 000 intervenants pour leur demander leurs commentaires par les voies suivantes :

- le portail Consultation auprès des Canadiens du gouvernement du Canada;

- des webinaires en direct avec interprétation simultanée, auxquels ont assisté plus de 130 participants;

- un sondage en ligne;

- des messages dans les médias sociaux et des messages électroniques pour solliciter la participation des autochtones et des femmes entrepreneurs du secteur;

- des messages envoyés aux principales universités de recherche du Canada;

- la mobilisation auprès du Conseil canadien de la jeunesse agricole (CCJA), un organisme consultatif auprès d'Agriculture et Agroalimentaire Canada;

- des messages envoyés aux abonnés à la liste de diffusion de l'ACIA.

Résultats

Au cours de la consultation de 60 jours entre le 18 janvier et le 19 mars 2021, l'ACIA a reçu :

- 1 400 vues/clics sur l'enquête en ligne;

- 800 réponses écrites aux 4questions clés de la consultation posées dans l'enquête en ligne (200 chacune);Note de bas de page 1

- 27 soumissions écrites par courriel.

La rétroaction résumée dans ce rapport a été compilée à partir de toutes ces sources, en plus des commentaires reçus lors des webinaires. Les commentaires ne figurent pas dans un ordre particulier et sont présentés tels qu'ils ont été reçus de la part des intervenants afin de minimiser les erreurs d'interprétation.

Thèmes principaux

5 thèmes principaux se sont dégagés de la rétroaction reçue au cours de cette consultation, qui est subdivisés en sous-thèmes. Ils sont présentés ci-dessous et expliqués en détail dans les cinq sections suivantes.

- Thème 1 – Harmonisation internationale

- Thème 2 – Coordination nationale

- Thème 3 – Prestation de programmes et de services

- Thème 4 – Exigences avant la mise sur le marché et processus d'approbation

- Thème 5 – Soutien sur mesure pour les petites et moyennes entreprises et les entreprises autochtones

Thème 1 – Harmonisation internationale

Les intervenants ont été clairs : le système de réglementation du Canada pour les produits agricoles et agroalimentaires doit être mieux harmonisé avec ceux de ses principaux partenaires commerciaux, notamment grâce à l'élimination des barrières commerciales non tarifaires.

L'approfondissement des partenariats internationaux pour promouvoir la prise de décisions fondées sur la science et l'harmonisation des normes, des procédures et de la mise en œuvre a également été souligné comme étant essentiel pour obtenir l'accès aux marchés.

- Accroître l'harmonisation des règlements et des programmes pour faciliter l'accès aux marchés internationaux

- Soutenir les innovateurs pour qu'ils fassent bonne figure à l'échelle mondiale

Accroître l'harmonisation des règlements et des programmes pour faciliter l'accès aux marchés internationaux

L'environnement réglementaire dans les différentes administrations gouvernementales et les coûts de conformité qui en découlent ont une incidence sur les décisions commerciales, en particulier pour les petites et moyennes entreprises (PME).

Il y a eu une forte pression pour mieux harmoniser et coordonner les exigences canadiennes avec celles des principaux partenaires commerciaux et pour mieux prendre en compte le paysage international, par exemple en utilisant des exigences et des normes acceptées dans le monde entier lors de l'élaboration de nouveaux règlements.

Les intervenants ont recommandé les domaines d'intérêt distincts suivants pour favoriser l'harmonisation avec les règlements et les programmes d'autres pays et aider le secteur agricole et agroalimentaire canadien à accéder aux marchés.

Accords et coopération technique

- Accorder la priorité aux accords de reconnaissance mutuelle (ARM) entre le Canada et d'autres pays afin d'appuyer les produits fabriqués au Canada et la capacité des entreprises canadiennes à exporter.

- Renouveler les efforts en vue d'élaborer une stratégie canado-américaine sur le périmètre, conformément à la Déclaration de 2011 sur une vision commune de la sécurité du périmètre et de la compétitivité économique, afin de faciliter le commerce et la croissance économique et de réagir rapidement aux menaces, comme la propagation de ravageurs envahissants.

- Élaborer des accords de zonage reconnus par les partenaires commerciaux pour permettre la reprise des échanges en cas de maladie animale exotique.

- Régler les problèmes techniques qui empêchent l'accès au marché chinois des produits canadiens de la volaille et des œufs en raison des restrictions liées au virus de la grippe aviaire hautement pathogène (H5N1).

- Discuter avec les principaux partenaires d'exportation de la manière de parvenir à une plus grande harmonisation et d'assurer la clarté des règlements et des politiques commerciales pour les PME aux prises avec des contraintes en matière de ressources.

- Négocier davantage d'accords d'équivalence avec d'autres pays pour les produits biologiques.

Harmonisation de la réglementation : généralités

- Mettre à jour la réglementation sur la génomique, la protéomique, notamment les exigences sur les tests de qualité des protéines, et les nanotechnologies. alimentaires afin de garantir l'harmonisation avec les autres exigences réglementaires internationales.

- Harmoniser les exigences d'étiquetage pour les allégations relatives à la teneur en protéines et en éléments nutritifs entre le Canada, les États-Unis, l'Europe et l'Australie.

- Harmoniser et rationaliser les règlements qui s'appliquent aux installations certifiées par l'ACIA.

- Les installations qui importent et exportent des produits doivent se conformer aux exigences fédérales.

- Les coûts supplémentaires que doivent assumer ces installations pour se conformer à la réglementation peuvent être prohibitifs, en particulier pour les petites et moyennes entreprises (PME).

- Harmoniser la surveillance relative aux types d'emballages.

- Réviser les règlements sur les parasites et les biopesticides, y compris, mais sans s'y limiter, les limites maximales de résidus, dans le but d'harmoniser les exigences fixées par nos principaux partenaires commerciaux.

- Harmoniser les exigences biologiques :

- Par exemple, effectuer tous les 5 ans des examens de routine financés par des fonds publics, du Régime Bio-Canada (RBC).

« L'amélioration de l'accès aux marchés passe par l'harmonisation avec les autres pays pour les produits exportés et importés, en particulier avec les principaux partenaires commerciaux. Cela renforce la confiance dans l'ensemble de l'industrie alimentaire, qui peut ainsi vendre ses produits sans difficulté dans l'un ou l'autre des pays, et contribue à minimiser les coûts de développement des produits. » (traduction)

Harmonisation réglementaire : exigences particulières

Les éléments suivants en particulier ont été soulignés comme ceux devant être harmonisés en priorité :

- les règlements relatifs à l'enrichissement, comme ceux qui concernent la farine de blé;

- les codes de lot pour les produits et autres denrées;

- les allergènes et déclarations prioritaires;

- les niveaux de contaminants pour des produits tels que les pesticides et les additifs alimentaires.

Approbations réglementaires

- Accroître la reconnaissance des processus d'essai, d'examen et d'approbation des produits d'autres administrations afin d'éviter le dédoublement des exigences d'échantillonnage et d'essai et les retards dans la mise sur le marché des produits.

- Envisager d'adopter des pratiques d'acceptation des ingrédients telles que le processus Generally Recognized as Safe (GRAS) aux États-Unis.

- Ces pratiques pourraient servir de modèle pour améliorer la transparence des ingrédients et des additifs qui ont déjà été évalués par des experts et sont reconnus comme sûrs lorsqu'ils sont utilisés comme prévu.

- Intégrer des considérations de coût dans le cadre de l'approbation des médicaments vétérinaires, notamment la variation des coûts entre le Canada, les États-Unis, l'Europe et la Chine.

Exécution des programmes

- Harmoniser le calendrier et la communication des mesures correctives liées aux éclosions de maladie, aux avis et aux rappels avec les autres administrations gouvernementale.

- Coordonner les annonces et les avis simultanés à l'industrie au Canada et aux États-Unis.

- Travailler avec d'autres partenaires commerciaux pour négocier des méthodes similaires au rogramme des importateurs autorisés (IA) de l'ACIA et au Programme canadien de certification phytosanitaire des semences (PCCPS).

- Celles-ci peuvent « offrir à l'industrie une plus grande souplesse indépendante » en lui déléguant le pouvoir d'exécuter certaines fonctions pour rationaliser les échanges commerciaux à la frontière.

- Utiliser les mêmes méthodes de laboratoire que les partenaires commerciaux, en particulier lorsque les résultats des tests seront utilisés à des fins d'application de la loi.

Soutenir les innovateurs pour qu'ils fassent bonne figure à l'échelle mondiale

De nombreux commentaires portent sur les processus d'approbation des nouvelles technologies de sélection des végétaux et des nouveaux ingrédients des aliments pour animaux. Nous avons entendu que nos processus d'approbation n'aident pas les innovateurs à suivre le rythme dans ces domaines hautement compétitifs ayant des concurrents du monde entier.

Par exemple, les approbations asymétriques de produits nouveaux, qui font en sorte que ces produits sont approuvés dans d'autres administrations mais pas au Canada, peuvent entraîner des obstacles commerciaux et une augmentation des coûts pour les entreprises canadiennes.

L'amélioration des partenariats en vue de surmonter ces obstacles et l'acceptation des décisions prises par des organismes de réglementation étrangers de confiance ont été mentionnées comme des moyens essentiels pour encourager l'innovation, la croissance et la compétitivité.

Parmi les suggestions visant à faciliter l'accès aux marchés internationaux pour les produits nouveaux, citons les suivantes :

- accélérer les approbations pour les produits qui sont réglementés dans d'autres pays et qui ont déjà été approuvés – il n'est « pas nécessaire de réinventer la roue »;

- éviter toute « exigence exclusivement canadienne » et soutenir la réforme de la réglementation;

- mieux harmoniser le Canada avec les États-Unis en assouplissant la réglementation sur les innovations agricoles résultant de la modification du génome des végétaux et envisager différentes méthodes pour adopter les technologies de modification de gènes utilisées par d'autres pays afin d'accroître l'accès des agriculteurs canadiens aux nouvelles technologies.

Ces suggestions portent sur l'harmonisation internationale, mais nous avons reçu beaucoup de commentaires sur tous les aspects des approbations avant la mise sur le marché. D'autres commentaires sur ce sujet sont résumés dans le thème 4.

« Le Canada est le seul pays au monde à soumettre la sélection conventionnelle de végétaux au même type d'évaluations de sécurité avant la mise sur le marché que les autres pays appliquent uniquement aux organismes génétiquement modifiés. Non seulement ce manque d'harmonisation désavantage les innovateurs canadiens, mais il rend plus difficile pour le Canada de s'associer à des pays aux vues similaires pour plaider en faveur d'une harmonisation réglementaire mondiale qui améliorera la prévisibilité du commerce. » (traduction)

Thème 2 – Coordination nationale

Afin de favoriser un environnement réglementaire clair et prévisible pour l'industrie, propice à la croissance, une coordination accrue entre tous les ordres de gouvernement et entre les ministères fédéraux est nécessaire.

La rétroaction reçue souligne systématiquement l'importance d'éliminer les obstacles au commerce interprovincial, de réduire le dédoublement entre les exigences fédérales, provinciales et territoriales (FPT), et de travailler ensemble pour souligner la qualité et la valeur des produits fabriqués au Canada.

- Travailler avec tous les ordres de gouvernement pour éliminer les obstacles au commerce interprovincial et obtenir une équivalence nationale

- Adopter une approche pangouvernementale en matière de réglementation

- Promouvoir les produits fabriqués au Canada et protéger la marque canadienne

Travailler avec tous les ordres de gouvernement pour éliminer les obstacles au commerce interprovincial et obtenir une équivalence nationale

Des appels pressants ont été lancés aux gouvernements fédéral, provinciaux et territoriaux pour qu'ils :

- éliminent les obstacles internes à l'accès aux marchés, y compris ceux déjà mentionnés dans les rapport du Conseil consultatif en matière de croissance économique de 2017 (le rapport Barton) et les rapports des Tables de stratégies économiques pour le secteur agricole et agroalimentaire;

- continuent à suivre les 7 principes directeurs en matière de réglementation et les priorités établis par les ministres de l'agriculture FPT en 2019, notamment :

- uniformiser l'interprétation, l'exécution et l'application de la réglementation entre les administrations gouvernementales;

- accélérer la relance économique à la suite de la pandémie de COVID-19, veiller à ce que la réglementation facilite le commerce intérieur et international tout en remplissant les objectifs de politique publique.

Les commentaires ont insisté sur l'élimination du dédoublement et des redondances, sur l'assurance de l'équivalence des normes étrangères par rapport aux normes canadiennes, et sur la collaboration lors de l'élaboration et de l'exécution des politiques et des règlements afin de réduire le fardeau pour l'industrie.

Plus précisément :

- élaborer une stratégie nationale de salubrité alimentaire qui harmoniserait toutes les exigences FPT et viserait toutes les exploitations alimentaires, indépendamment de leur taille ou de leur emplacement;

- élaborer des processus ou des accords tels que des protocoles d'entente avec les provinces et territoires pour rationaliser les inspections et utiliser plus efficacement les ressources d'inspection tout en réduisant la charge des parties réglementées;

- rechercher l'équivalence réglementaire entre les produits alimentaires nationaux et importés et réduire tout effort disproportionné de mise en conformité et d'application sur les produits nationaux par rapport aux importations;

- poursuivre les efforts actuels sur l'outil d'évaluation de la comparabilité nationale afin d'améliorer et d'accroître les ventes interprovinciales de viande rouge;

- solliciter davantage de commentaires et de soutien de la part des provinces et des territoires sur l'équité des règles du jeu pour les produits nouveaux, par l'intermédiaire du sous-comité FPT sur l'agilité réglementaireNote de bas de page 2

« Les producteurs nationaux d'aliments sont tenus de respecter des normes plus strictes, tout en devant concurrencer des aliments produits dans des pays où le fardeau réglementaire est moins lourd et qui ont accès à des coûts d'intrants moins élevés et à des intrants qui ne sont pas disponibles au Canada. » (traduction)

Adopter une approche pangouvernementale en matière de réglementation

On nous a dit que pour réaliser pleinement la compétitivité, l'innovation et la croissance économique inclusive dans le secteur agricole et agroalimentaire, il faut une meilleure coordination entre les nombreux ministères et organismes fédéraux qui réglementent et offrent des programmes et des services au secteur.

On a insisté sur l'adoption d'une approche pangouvernementale pour renforcer la collaboration avec d'autres organismes de réglementation et ministères lors de l'élaboration de nouvelles exigences.

Voici ces suggestions :

Coordination à l'échelle fédérale

- Donner la priorité à l'atteinte des objectifs de commerce et d'accès aux marchés en collaborant plus étroitement avec le Secrétariat de l'accès aux marchés d'Agriculture et Agroalimentaire Canada (AAC), le Service des délégués commerciaux du Canada d'Affaires mondiales Canada et Exportation et développement Canada.

- Rendre obligatoire l'efficacité de la réglementation, la croissance économique et l'adoption d'une démarche coordonnée lors de l'examen de la réglementation.

- Cela devrait permettre une évaluation plus globale du coût, de la complexité et de la charge administrative sur l'industrie.

- Au lieu de perturber les entreprises avec une série de projets de changements disjoints de la part des organismes de réglementation fédéraux dans un court laps de temps, assurer la coordination pour minimiser les perturbations de la production.

- Mieux tirer parti des initiatives existantes de l'industrie et du gouvernement, comme la Table sur la réglementation souple d'Agriculture et Agroalimentaire Canada (AAC).

« L'ACIA doit collaborer avec l'ensemble du gouvernement pour veiller à ce que les exigences réglementaires imposées soient uniformes et respectent des délais similaires. » (traduction)

Coordination au sein du portefeuille fédéral de l'agriculture

- Réunir à nouveau les anciens comités consultatifs, notamment la Table ronde sur la chaîne de valeur des produits biologiques, le Bureau Bio-Canada et le Comité consultatif externe sur la compétitivité réglementaire.

- Travailler avec d'autres ministères pour reconnaître les programmes associés au Programme de reconnaissance de la salubrité des aliments (PRSA) de l'ACIA comme répondant largement aux exigences réglementaires afin d'accroître la prévisibilité et de réduire le dédoublement et la charge administrative sur les agriculteurs canadiens.

- Inclure le secteur biologique aux tables de discussion telles que le groupe de travail sur la modernisation de la réglementation sur les semences.

Coordination entre l'ACIA et Santé Canada

- Améliorer la communication entre l'ACIA et Santé Canada pour veiller à ce que les nouveaux règlements soient cohérents, qu'ils ne se chevauchent pas et que les exigences connexes puissent être mises en œuvre par l'industrie dans des délais similaires.

- Par exemple, la Consultation sur l'énoncé de politique conjoint proposé sur la coordination de l'étiquetage des aliments de 2021 de Santé Canada et de l'ACIA a été citée comme une stratégie modèle lorsqu'il s'agit de coordonner les futurs changements aux exigences d'étiquetage des aliments.

- Créer une plateforme centrale unique pour la publication des informations de l'ACIA et de Santé Canada, y compris les Avis de proposition et les Avis de modification, afin de communiquer clairement à l'industrie tous les changements proposés ou récents.

- Organiser les documents ministériels qui ont été incorporés par renvoi afin qu'ils soient plus facilement accessibles à partir d'un seul endroit.

« Pour réduire la charge et les coûts associés, le délai pour se conformer aux nouvelles réglementations doit être approprié non seulement du point de vue de la durée, mais doit également minimiser les perturbations de la chaîne d'approvisionnement. Ces deux considérations sont essentielles pour réduire la charge sur l'industrie… » (traduction)

Promouvoir les produits fabriqués au Canada et protéger la marque canadienne

Des appels ont été lancés pour que davantage de mesures soient prises pour promouvoir et protéger les normes élevées de salubrité alimentaire du Canada et pour soutenir l'augmentation de la capacité de transformation de davantage de produits au niveau national afin de faciliter l'accès aux marchés. Voici des suggestions reçues :

- Achever les initiatives de marketing « Marque du Canada », d'étiquetage « Produit du Canada » et d'allégations « Produit du Canada » afin de renforcer la compétitivité des aliments produits au pays et de l'industrie canadienne.

- Réglementer l'utilisation de l'« étiquette biologique canadienne »/du logo biologique canadien.

- Rétablir un comité d'interprétation des normes pour les produits biologiques.

- « Autopromouvoir les aliments produits au Canada » en augmentant l'accès aux marchés pour les producteurs provinciaux en éliminant les surtaxes sur les produits d'exportation.

- Encourager l'achat de produits fabriqués au Canada et la production canadienne à petite échelle, et promouvoir les produits fabriqués localement grâce à des initiatives conjointes de l'ACIA et de l'industrie.

- Créer une exemption aux exigences actuelles relatives aux produits laitiers pour permettre la vente de produits laitiers crus et non pasteurisés.

« … [L'ACIA devrait] collaborer avec d'autres organismes et souligner la qualité supérieure (de la ferme à la table) ainsi que la valeur nutritionnelle des céréales, des oléagineux et des cultures cultivés au Canada. » (traduction)

Thème 3 – Prestation de programmes et de services

Il est urgent de continuer à améliorer la prestation des services et des programmes de l'ACIA, notamment en augmentant la réceptivité, en numérisant, en rationalisant l'exécution des programmes et en renforçant la cohérence du point de vue de la conformité et de l'application de la loi.

Par exemple, les intervenants ont clairement indiqué que l'ACIA prend parfois plusieurs semaines ou mois pour répondre à leurs questions. Ce retard a un effet dissuasif et a été cité comme l'un des principaux coûts ayant une incidence sur les possibilités commerciales au Canada et à l'étranger.

En outre, l'élan accru en faveur de l'adoption de pratiques plus modernes de gestion des affaires et de l'information provoqué par la pandémie de COVID-19 doit être maintenu, voire renforcé. L'ACIA a été invitée à poursuivre la mise en place de plateformes électroniques afin d'accroître l'accessibilité et la transparence de ses processus.

- Réduire les retards administratifs

- Numériser les services

- Collaborer avec des tiers de confiance pour la prestation des programmes et des services

- Vérifier la conformité et appliquer la loi selon une approche claire et cohérente

Réduire les retards administratifs

Nous avons entendu la nécessité de réduire les retards administratifs liés aux processus manuels, sur papier, d'améliorer les délais de réponse aux questions des intervenants, notamment :

- assurer une réponse rapide aux autres pays qui demandent des informations sur des documents liés à l'exportation;

- mettre en place un système de suivi en ligne pour les examens et les approbations;

- rationaliser les exigences relatives aux processus de certificats sanitaires pour les marchés d'exportation de produits laitiers et les demandes d'importation;

- remédier aux longs délais d'attente pour l'enregistrement des variétés de semences;

- disposer de ressources sur le terrain et équipées pour répondre aux questions réglementaires;

- améliorer l'accessibilité des documents d'orientation sur le site Web de l'ACIA.

« J'ai attendu 11 mois pour recevoir une réponse à l'une de mes propres demandes de clarification, et la réponse était "non, nous ne faisons pas cela", ce qui a créé encore plus de consternation. » (traduction)

Numériser les services

Il y a eu un soutien considérable pour que l'ACIA continue à augmenter son offre de services en ligne, en particulier la livraison numérique des documents requis pour obtenir l'accès aux marchés. Plus précisément :

- numériser les transactions et les certificats financiers;

- le Canada accuse un retard par rapport aux États-Unis dans la livraison de certificats phytosanitaires électroniques, ce qui place la chaîne de valeur des semences et des grains dans une situation de désavantage concurrentiel;

- simplifier et numériser le processus d'enregistrement des engrais au Canada afin de réduire les retards;

- les intervenants ont mentionné des arriérés allant « jusqu'à 8mois dans l'examen de l'enregistrement des engrais et des suppléments », ce qui entrave considérablement l'accès aux marchés pour le secteur;

- explorer l'utilisation de la technologie de la chaîne de blocs pour « protéger l'intégrité des produits canadiens » grâce à une meilleure traçabilité;

- en outre, harmoniser les efforts réglementaires et explorer la technologie de chaîne de blocs auprès d'autres pays pour améliorer la transparence et réduire les risques;

- il est essentiel que les intervenants soient mobilisés tôt et, dans bien des cas, préparés à la mise en œuvre éventuelle de cette technologie;

- intégrer les exigences d'importation de produits biologiques dans le Système automatisé de référence à l'importation (SARI) de l'ACIA;

- poursuivre les travaux visant à délivrer des certificats d'exportation en ligne par l'intermédiaire de la plateforme Mon ACIA et à améliorer la cohérence et l'intégration de tous les systèmes du gouvernement du Canada.

« Les certificats phytosanitaires sur support papier sont encore fournis aux entreprises de semences, et l'entreprise de semences les reçoit encore manuellement. » (traduction)

Collaborer avec des tiers de confiance pour la prestation des programmes et des services

De nombreux commentaires demandent plus de clarté sur les certifications privées, les programmes de négociants dignes de confiance, la diversification de la prestation des services et leurs incidences sur la fréquence de la surveillance de l'ACIA.

Voici ces suggestions :

- diversifier les modes de prestation de services dans des domaines tels que la logistique numérique, les processus douaniers et les documents douaniers numériques préapprouvés afin d'accélérer le service et de faciliter le commerce;

- Clarifier les schémas de certification par des tiers. Par exemple :

- en montrant comment ils aident les participants se conformer aux exigences réglementaires;

- si participation aux ces schémas aura une incidence sur le niveau de surveillance réglementaire de l'ACIA;

- reconnaître les investissements réalisés dans les certifications par une tierce partie, et l'accès aux systèmes de certification d'une tierce partie correspondants;

- examiner les redondances dans les exigences de certification entre les programmes privés de salubrité des aliments reconnus par l'ACIA, comme le programme CanadaGAP pour les fruits et légumes, et les exigences du Règlement sur la salubrité des aliments au Canada (RSAC);

- élargir la portée d'autres programmes de salubrité des aliments semblables à CanadaGAP, comme le Programme des partenaires pour la qualité au Canada (PPQ-C);

- ce programme fournit un système d'inspection intégré comme équivalence à l'inspection traditionnelle, sur place, par l'ACIA pour les pommes de terre de table exportées aux États-Unis;

- élargir la portée du programme des importateurs autorisés (IA) and the Programme canadien de certification phytosanitaire des semences (PCCPS) pour faciliter davantage l'importation de semences internationales et leur exportation vers les États-Unis;

- continuer d'explorer les souplesses dans l'application des normes, comme le Programme des bovins d'engraissement sous restriction qui réduit le fardeau en permettant l'importation au Canada d'animaux en provenance des États-Unis sans exigences de tests, sous réserve de certaines conditions.

Vérifier la conformité et appliquer la loi selon une approche claire et cohérente

Plusieurs commentaires soulignent la nécessité pour l'ACIA de s'attaquer aux problèmes existants liés à la vérification de la conformité et à l'application de la loi selon une approche cohérente et équitable. Nous avons reçu les recommandations suivantes :

- offrir davantage de formation aux inspecteurs de l'ACIA et à l'industrie sur les nouvelles exigences réglementaires;

- l'incohérence des pratiques d'inspection, de l'interprétation et de l'application des règlements, ainsi que la lenteur des délais de réponse de l'ACIA peuvent être coûteuses pour les entreprises et avoir une incidence sur leur compétitivité sur les marchés nationaux et étrangers;

- assurer une plus grande transparence concernant la conformité des produits importés;

- se pencher sur les problèmes que posent les importations frauduleusement étiquetées qui menacent la production nationale et l'accès aux marchés. Par exemple, un poulet importé qui est déclaré comme « volaille de réforme » pour contourner les contrôles à l'importation;

- acquérir la capacité de tester les produits importés et exportés par rapport à une norme reconnue afin de vérifier l'intégrité des produits;

- établir des critères microbiologiques pour les produits alimentaires afin de réduire l'ambiguïté et de fournir des directives supplémentaires aux PME;

- promouvoir et faire respecter les normes fédérales d'identité des produits laitiers ainsi que leurs noms communs;

- chercher à corriger un déséquilibre perçu dans l'application de la loi par l'ACIA entre les « semences généalogiques et les semences communes »;

- ce déséquilibre touche les redevances et les investissements dans la sélection liés aux semences généalogiques.

Thème 4 – Exigences avant la mise sur le marché et processus d'approbation

Les exigences et les approbations avant la mise sur le marché, y compris la priorisation des approbations pour les produits nouveaux, ont été soulignées comme des domaines nécessitant une attention immédiate.

Les nombreux commentaires reçus soulignent la nécessité de rationaliser et de clarifier davantage les exigences réglementaires, de chercher à assurer une uniformité avec les partenaires internationaux et de créer un environnement réglementaire plus clair et plus prévisible pour faciliter la recherche et le développement de nouveaux produits.

- Améliorer les normes de service et la prévisibilité

- Accorder la priorité aux approbations de produits nouveaux au Canada

Améliorer les normes de service et la prévisibilité

Les organismes de réglementation doivent donner des certitudes à l'industrie quant à leurs normes de service pour les produits nouveaux et s'efforcer de clarifier et de rationaliser les lourdes exigences réglementaires avant la mise sur le marché.

Pour atteindre cet objectif, nous avons entendu qu'il faut :

- assurer la prévisibilité des autorisations avant la mise sur le marché des innovations grâce à des lignes directrices claires en matière de soumission pour les végétaux et les aliments pour animaux, notamment ceux qui font appel aux nouvelles technologies génomiques;

- ces facteurs continuent d'entraver la capacité de l'industrie à accéder aux variétés de semences et aux produits innovants de santé des végétaux;

- le Canada accuse un retard par rapport à des pays comme le Japon, l'Australie, la Nouvelle-Zélande et les États-Unis en ce qui concerne le soutien de la capacité de son industrie à concurrencer des entreprises sur le plan mondial;

- augmenter les délais d'enregistrement des produits nouveaux : par exemple, l'enregistrement des produits dérivés de l'avoine;

- si l'on n'y remédie pas, les produits conçus au Canada finissent par être fabriqués dans d'autres pays;

- fournir des directives plus claires sur les produits nouveaux et améliorer le délai de réponse aux questions;

- établir des normes de service en fonction des risques posés par les produits nouveaux;

- mettre en œuvre une norme de service exigeant que les certificats phytosanitaires soient délivrés dans un délai maximum de 5 jours à compter de la réception de la demande en ligne, en fonction des exigences de tests et de la destination;

- créer un mécanisme permettant à l'industrie de demander un examen indépendant ou une réparation en cas de problèmes réglementaires ayant une incidence sur le traitement d'une demande.

Accorder la priorité aux approbations de produits nouveaux au Canada

Les intervenants ont déclaré que les processus d'approbation, en particulier pour les nouveaux produits végétaux et les nouveaux ingrédients des aliments pour animaux, doivent suivre le rythme du marché et que des investissements sont nécessaires pour accélérer ces processus. Ils ont mentionné qu'à leur avis, la pandémie de COVID-19 a rendu encore plus difficiles les problèmes que pose la lenteur des approbations.

Nous avons demandé aux intervenants s'ils étaient favorables à l'établissement d'un ordre de priorité pour l'approbation de certains produits nouveaux que l'ACIA réglemente, tout en tenant compte de la nécessité de maintenir des règles du jeu équitables pour l'industrie.

Soutien à la priorisation de la réglementation

En général, nous avons appris qu'il y a un soutien modéré pour la priorisation.

Les domaines en particulier où elle pourrait être envisagée sont les suivants :

- réévaluation de la nécessité d'une évaluation de l'innocuité des végétaux à caractères nouveaux avant leur mise sur le marché;

- la suppression de cette exigence pour les produits de sélection traditionnels inciterait et aiderait les petites et moyennes entreprises (PME) et les peuples autochtones du secteur à innover et à développer de nouveaux produits;

- approbations liées à l'atténuation des ravageurs et des maladies;

- production de produits à valeur ajoutée pour répondre à l'évolution des besoins des consommateurs et du marché en commodité, y compris ceux produits par le secteur de la pêche.

En plus du soutien : mise en garde

Bien que de nombreux répondants aient vivement exprimé leur soutien à la priorisation des produits nouveaux, en particulier ceux qui sont enregistrés et ont un historique d'utilisation sûre dans d'autres pays, certains intervenants ont averti que l'accès aux marchés pour les produits existants devrait rester une priorité.

D'autres préoccupations ont été soulevées quant au fait que la priorité accordée aux produits nouveaux pourrait signifier que les organismes génétiquement modifiés (OGM), la technologie d'édition de gènes ou courtes répétitions palindromiques regroupées et régulièrement espacées (CRISPR-Cas), et d'autres techniques de sélection ciblées seraient privilégiés par rapport aux méthodes traditionnelles de production alimentaire.

Si la priorisation est l'option choisie, nous avons entendu qu'il est important de continuer à :

- maintenir et élargir l'accès aux marchés pour les produits existants et approuvés, ainsi que la nécessité d'une plus grande déréglementation en fonction des priorités, tout en adhérant à des normes strictes et à une surveillance de la salubrité alimentaire;

- respecter les règles et normes d'étiquetage établies, et veiller à ce que les produits existants et nouveaux bénéficient du même soutien de l'ACIA;

- par exemple, en veillant à ce que les substituts végétaux des produits de viande soient étiquetés de manière appropriée et véridique;

- maintenir l'accès aux produits nécessaires, et ne pas provoquer de perturbations inutiles de la chaîne d'approvisionnement;

- reconnaître que des ressources supplémentaires de l'ACIA peuvent être nécessaires pour appuyer des activités de vérification de la conformité et d'application de la loi connexes et efficaces;

- être totalement transparent et veiller à ce que toutes les intervenants du secteur disposent des mêmes informations.

Uniformisation des règles du jeu

Les intervenants ont exprimé la nécessité d'un engagement plus poussé pour confirmer ce que la troisième question de la consultation entendait par « règles du jeu équitables »; ils ont fait remarquer qu'à leur avis, des règles du jeu équitables signifient que les efforts de hiérarchisation de la réglementation doivent :

- prioriser les activités de réglementation de l'ACIA afin de mieux s'harmoniser aux principes de soutien d'une économie concurrentielle par une croissance économique inclusive, l'entrepreneuriat et l'innovation, comme l'exige la Directive du Cabinet sur la réglementation

- fournir « une liberté et une plus grande latitude dans la définition des cultures » pour répondre aux préoccupations concernant le système d'enregistrement des variétés et établir des partenariats pour distinguer les cultures canadiennes des autres produits « commercialisés en masse »;

- créer plus de clarté et de souplesse sur l'étiquetage, ainsi qu'un environnement équitable pour les produits de base traditionnels afin de faciliter l'accès aux marchés pour les substituts à base de végétaux, les nouvelles protéines et les intrants agricoles, y compris les engrais.

L'élaboration d'une démarche mutuellement avantageuse serait idéalement entreprise dans le cadre de discussions ouvertes et collaboratives entre l'ACIA et les parties réglementées sur les critères de priorisation des nouveaux produits et l'élaboration d'une définition mutuellement acceptée de « règles du jeu équitables ».

Thème 5 – Soutien sur mesure pour les petites et moyennes entreprises et les entreprises autochtones

Tout au long de la consultation, les intervenants représentant les petites et moyennes entreprises (PME) ont fréquemment exprimé le point de vue selon lequel ils contribuent grandement à l'innovation dans le secteur agricole et agroalimentaire, mais qu'ils sont confrontés à des défis en raison de leurs ressources, qui sont plus limitées que celles des grands producteurs. Par conséquent, les PME ont besoin de plus de mobilisation, d'orientation, d'éducation et de soutien de la part de l'ACIA et des principaux partenaires d'exportation pour mieux comprendre les règlements et les politiques commerciales.

- Soutenir les petites et moyennes entreprises (PME) du Canada

- Concevoir des méthodes culturellement compétentes pour faire avancer la réconciliation et le soutien des entreprises autochtones

Soutenir les petites et moyennes entreprises (PME) du Canada

On nous a fait part de la nécessité pour l'ACIA de fournir davantage de directives à l'industrie pour aider à clarifier et à améliorer la compréhension des diverses exigences réglementaires et des programmes, et de s'engager de façon significative auprès des intervenants pour trouver de nouvelles façons de réduire le fardeau réglementaire sur l'industrie.

Les répondants sont fortement en faveur de mesures visant à aider les PME à comprendre le commerce, les règlements et les exigences réglementaires, car celles-ci manquent souvent de ressources et d'expertise à l'interne. Il est également important de veiller à ce qu'elles aient voix au chapitre lors des consultations de l'ACIA afin que leurs besoins soient pris en compte dans les programmes et services de l'agence.

On nous a dit qu'offrir ce soutien et qu'accroître les services aux PME, tant en ligne que dans les bureaux de l'ACIA partout au Canada, contribuerait grandement à réduire les obstacles à la croissance et à l'innovation pour ces entreprises.

Voici ces suggestions :

- créer un groupe axé sur le service au sein de l'ACIA pour aider les PME et d'autres groupes sous-représentés à se conformer à la réglementation;

- aider les PME du secteur alimentaire qui ont des difficultés à comprendre dans quelle mesure la réglementation et le Règlement sur la salubrité des aliments au Canada les concernent;

- organiser des séances d'information sur les conditions d'accès aux marchés afin d'aider les PME à mieux anticiper les défis et les problèmes potentiels;

- élaborer en collaboration des stratégies propres au marché pour aider les PME à étendre leur portée dans les provinces;

- améliorer l'aide apportée aux entreprises pour qu'elles puissent s'orienter dans les processus réglementaires, et favoriser « la transparence, l'orientation et le renforcement des capacités » dans les différents secteurs;

- continuer à consulter les intervenants de manière préventive sur les problèmes potentiels d'accès aux marchés;

- par exemple, les restrictions et les nouvelles exigences imposées aux importations par certains pays dans le cadre de leur réponse à la pandémie de COVID-19;

- consulter davantage l'industrie sur les changements d'étiquettes, secteur par secteur;

- accorder suffisamment de temps aux intervenants pour qu'ils puissent participer aux consultations;

- une période de consultation de 30 à 60 jours est insuffisante pour permettre à de nombreuses associations industrielles d'apporter une contribution éclairée, car elles ont besoin de plus de temps pour mobiliser leurs membres;

- contribuer aux coûts de certification biologique des PME afin de les aider à répondre à la demande croissante de produits biologiques.

« Soyez un allié des petites entreprises sur la scène mondiale. Il est possible d'y arriver en misant sur la transparence et en déployant des efforts pour établir une confiance mutuelle avec les partenaires commerciaux et les consommateurs. » (traduction)

Concevoir des méthodes culturellement compétentes pour faire avancer la réconciliation et le soutien des entreprises autochtones

Les intervenants ont mentionné que l'ACIA doit améliorer la sensibilisation et la mobilisation des peuples autochtones, dont beaucoup sont confrontés à des obstacles uniques et sont relativement nouveaux dans l'agriculture commerciale.

Pour garantir une bonne compréhension, il a été souligné que cet engagement devrait être mené au niveau communautaire et que les démarches devraient être élaborées conjointement avec les communautés, les entreprises et les entrepreneurs autochtones.

Les recommandations spécifiques reçues sont présentées ci-dessous et sont regroupées dans deux domaines principaux : créer des occasions par la réconciliation et fournir un soutien culturellement compétent aux entreprises autochtones.

Créer des occasions par la réconciliation

- Explorer comment les connaissances traditionnelles autochtones peuvent soutenir la gestion des risques et la salubrité alimentaire, en utilisant des approches telles que la « double perspective » qui rassemble les forces des connaissances autochtones et générales pour atteindre les résultats attendus et se conformer aux exigences réglementaires.

- Commencer à combler les lacunes existantes exacerbées par la pandémie de COVID-19 en renforçant et en développant les capacités de la chaîne d'approvisionnement alimentaire dans les communautés nordiques, rurales et isolées, en partenariat avec les fabricants de produits alimentaires inspectés par la province.

- Examiner si les droits autochtones sont reconnus dans les politiques de l'ACIA.

- Plus précisément, clarifier la manière dont l'affirmation de l'autonomie des peuples autochtones et l'octroi de licences pour les exploitations aquacoles autochtones s'harmonisent avec le cadre réglementaire actuel.

- Accroître le dialogue autour des aliments utilisés à des fins traditionnelles, sociales et cérémonielles afin de « comprendre le potentiel du marché futur et les obstacles au commerce ».

- Intégrer des mesures dans les programmes d'importation et d'exportation de l'ACIA pour aider à protéger les peuples autochtones et les forêts indigènes.

Offrir du soutien culturellement compétent pour les entreprises autochtones

- Établir un partenariat avec les bureaux des conseils de bande et les associations gérées par des autochtones avant de lancer les consultations, afin de s'assurer que la langue est appropriée, adaptée à la culture et traduite dans les dialectes régionaux.

- Reconnaître le caractère unique de chaque communauté autochtone.

- Adopter une approche fondée sur les distinctions lors de l'élaboration des politiques et l'établissement de relations de nation à nation et de gouvernement à gouvernement pour appuyer les peuples autochtones menant des activités agricoles.

- Travailler avec d'autres ministères et organismes fédéraux, notamment Services aux Autochtones Canada, Santé Canada et Agriculture et Agroalimentaire Canada, afin d'effectuer des inspections et d'élaborer des programmes qui soutiennent les Autochtones dans le secteur.

- Tenir compte des besoins particuliers des Premières Nations vivant dans les réserves et améliorer l'accès aux programmes d'assurance et d'inspection grâce à une sensibilisation plus proactive, à la communication de l'information et à des services de type conciergerie.

- Soutenir les ressources existantes en développement industriel et économique dans le secteur privé et à but non lucratif pour aider les PME et les entrepreneurs autochtones.

- Créer un volet distinct pour les produits de guérison traditionnels, y compris le soutien aux laboratoires et aux essais.

« Travailler dans un cadre de risque nécessite une "double perspective", c'est-à-dire comprendre que les connaissances traditionnelles et les méthodes traditionnelles de collecte des aliments peuvent interagir de manière sûre et conforme lorsqu'un dialogue et une compréhension appropriés ont lieu… » (traduction)

Renseignements démographiques sur les participants

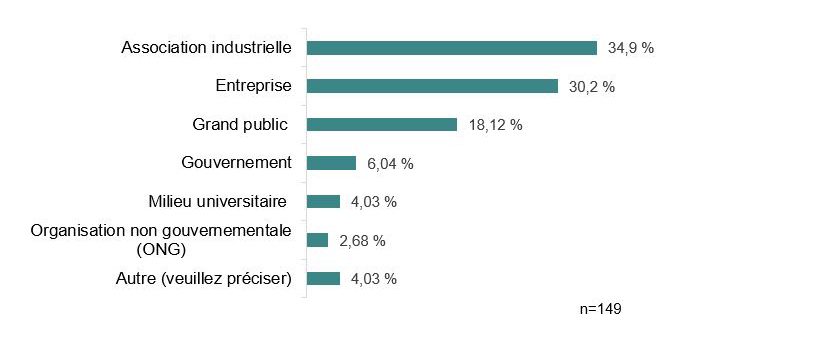

Figure 1. Diagramme à barres montrant le profil des intervenants ayant participé à la consultation. Le graphique montre que 2/3 des participants en ligne qui ont rempli le questionnaire sur les renseignements démographiques se sont identifiés comme des entreprises et des associations de l'industrie.

Description du profil des démographiques sur les participants

| Intervenant | pourcentage |

|---|---|

| Association industrielle | 34,9 % |

| Enterprise | 30,2 % |

| Grand public | 18,12 % |

| Gouvernement | 6,04 % |

| Milieu universitaire | 4,03 % |

| Organisation non gouvernementale (ONG) | 2,68 % |

| Autre (veuillez préciser) | 4,03 % |

n=149 (nombre de réponses à la question)

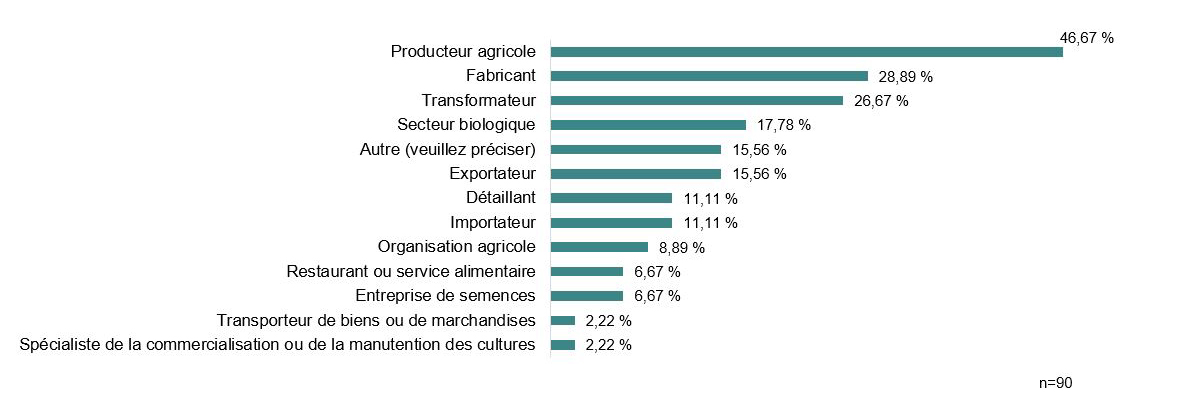

Figure 2. Diagramme à barres montrant les participants, par types d'entreprises, qui se sont identifiés comme représentant une entreprise. Près de la moitié se sont identifiés comme des producteurs agricoles.

Description du types d'entreprises ayant participé à la consultation

| Type d'entreprise | pourcentage |

|---|---|

| Producteur agricole | 46,67 % |

| Fabricant | 28,89 % |

| Transformateur | 26,67 % |

| Secteur biologique | 17,78 % |

| Autre (veuillez préciser) | 15,56 % |

| Exporateur | 15,56 % |

| Détaillant | 11,11 % |

| Importateur | 11,11 % |

| Organisation agricole | 8,89 % |

| Restaurant ou service alimentaire | 6,67 % |

| Entreprise de semences | 6,67 % |

| Transporteur de biens ou de marchandises | 2,22 % |

| Spécialiste de la commercialisation ou de la manutention des cultures | 2,22 % |

n=90 (nombre de réponses à la question)

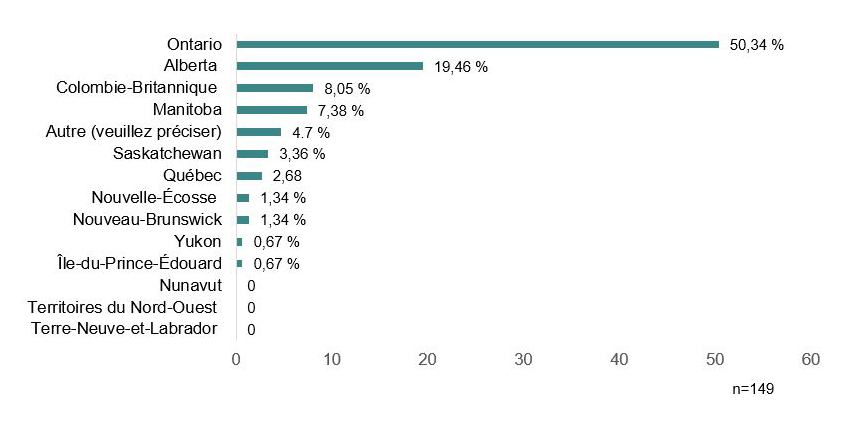

Figure 3. Diagramme à barres montrant les participants à la consultation en ligne par province ou territoire.

Description du participants à la consultation par lieu géographique

| Lieu geographique | pourcentage |

|---|---|

| Ontario | 50,34 % |

| Alberta | 19,46 % |

| Colombie-Britannique | 8,05 % |

| Manitoba | 7,38 % |

| Autre (veuillez préciser) | 4,7 % |

| Saskatchewan | 3,36 % |

| Québec | 2,68 % |

| Nouvelle-Écosse | 1,34 % |

| Nouveau-Brunswick | 1,34 % |

| Yukon | 0,67 % |

| Île-du-Prince-Édouard | 0,67 % |

| Nunavut | 0 % |

| Territoires du Nord-Ouest | 0 % |

| Terre-Neuve-et-Labrador | 0 % |

n=149 (nombre de réponses à la question)

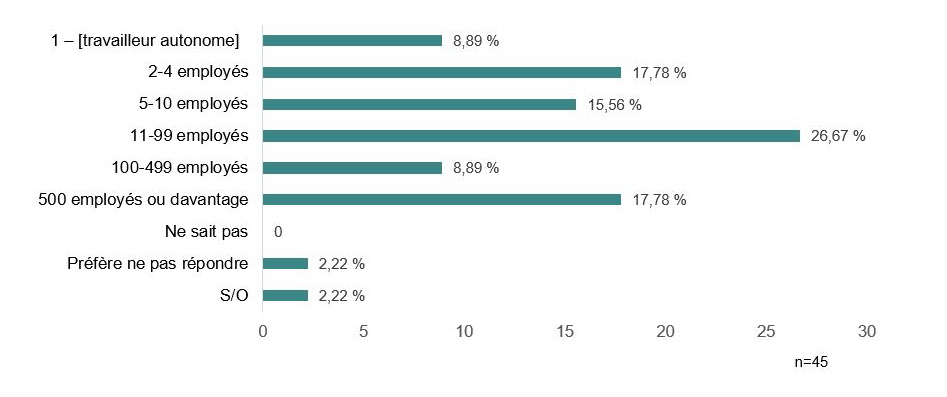

Figure 4. Diagramme à barres montrant le nombre d'employés des participants qui se sont identifiés comme représentant une entreprise. Près de 80 % des participants ayant répondu à cette question représentent une petite ou une moyenne entreprise (PME).

Description du Entreprises ayant participé à la consultation par nombre d'employés

| Nombre d'employés | pourcentage |

|---|---|

| 1 (travailleur autonome) | 8,89 % |

| 2-4 employés | 17,78 % |

| 5-10 employés | 15,56 % |

| 11-99 employés | 26,67 % |

| 100-499 employés | 8,89 % |

| 500 employés ou davantage | 17,78 % |

| Ne sait pas | 0 % |

| Préfére ne pas répondre | 2,22 % |

| S/O | 2,22 % |

n=45 (nombre de réponses à la question)

Prochaines étapes

Tous les commentaires résumés dans ce rapport seront analysés et utilisés pour orienter les efforts ultérieurs dans le but de favoriser la compétitivité et l'innovation dans le secteur agricole et agroalimentaire.

Merci

L'ACIA tient à remercier tous les participants qui ont consacré leur temps, leurs ressources et leurs idées à ce processus. Votre contribution pendant la pandémie actuelle de COVID-19, une période de difficultés sans précédent pour de nombreux Canadiens et peuples autochtones ayant des liens avec l'industrie agricole et agroalimentaire, est reconnue et appréciée. Avec votre aide, l'ACIA s'engage à contribuer à l'édification d'un secteur encore plus fort, plus compétitif et plus résilient qui continuera de servir les Canadiens et les intervenants à l'échelle internationale.

Des commentaires sur ce rapport

Écrivez-nous à l'adresse : cfia.programpolicy-politiqueprogramme.acia@inspection.gc.ca