This page has been archived

Information identified as archived is provided for reference, research or record-keeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please contact us to request a format other than those available.

On this page

- Executive summary

- Consultation purpose and methodology

- Results

- Main themes

- Participant demographics

- Next steps

- Thank you

- Feedback about this report

What we heard report: Framing competitiveness and innovation for success

(PDF format, 2090 kb, 33 pages)

Published March 2022

Executive summary

The Canadian Food Inspection Agency (CFIA) has a mandate to safeguard food, animals, plants and support international trade and market access. As such, it plays an essential role in facilitating competitiveness, innovation and inclusive economic growth in the agriculture and agri-food sector.

Through feedback gathered from the 2018 Economic Strategy Tables, the 2019 Agri-food and Aquaculture Regulatory Review Roadmap, and the Standing Senate Committee on Agriculture and Forestry's 2020 report: Made in Canada: Growing Canada's Value-Added Food Sector, stakeholders have expressed the need for CFIA and other departments to consider the impacts of regulations and regulatory decisions on sector competitiveness and innovation.

In addition, the new challenges of the COVID-19 pandemic have shown us that more flexible, agile regulations could help facilitate interprovincial trade and economic recovery in the sector, while building resiliency and enhancing preparedness for the future.

Given this context, CFIA held a 60-day public consultation from January 18, 2021 to March 19, 2021 on Framing competitiveness and innovation for success to examine how to further strengthen its regulations, programs, and services to help enable competitiveness and innovation in the agriculture and agri-food sector.

This report sets out the 5 thematic areas that have been identified by stakeholders for future investment by the agency.

- International alignment and harmonization: Increasing alignment of regulations and programs to facilitate market access and supporting innovators to compete globally

- Domestic coordination: Working with all levels of government to address interprovincial trade barriers and achieve domestic equivalency, employ a whole of government approach to regulation and promote and protect the Canadian brand

- Program and service delivery: Reducing administrative delays, digitizing services, collaborating with trusted third parties to deliver programs and clear, consistent compliance and enforcement

- Pre-market requirements and approvals for new/ novel products: Clarifying and streamlining pre-market regulatory requirements, and prioritization of approvals of new/novel products in Canada

- Tailored programming for small, medium, and Indigenous businesses: Supporting Canada's small and medium-sized enterprises (SMEs) and developing culturally competent approaches to advance reconciliation and support Indigenous businesses

Consultation purpose and methodology

Objective

- To examine how best to position CFIA programs, services and regulations going forward to support economic recovery and enhance the agriculture and agri-food sector's resiliency.

To meet this objective, CFIA asked stakeholders the following 4 questions:

- Where do you see the greatest need for the CFIA to examine cumulative economic impact of incremental regulatory requirements on the agriculture and agri-food sector?

- Where do you see that the CFIA would best support the agriculture and agri-food sector in gaining market access?

- To what extent do you support prioritization of regulatory activities to facilitate market access of new/novel products given the CFIA mandate and the need to promote a level playing field for regulated parties?

- How do you see the CFIA positioning itself to support small and medium-sized enterprises (SMEs) and Indigenous peoples with agriculture operations?

Who we consulted

- industry associations

- consumer associations

- businesses in the agriculture and agri-food sector, including SMEs and businesses operated by diverse population groups

- members of the general public

- other levels of government

- academia

- non-governmental organizations (NGOs)

What we did

The CFIA reached out to an estimated 3,000 stakeholders to request their feedback through the following channels:

- the Government of Canada's Consulting with Canadians portal

- live webinars with simultaneous interpretation, that were attended by more than 130 participants

- online survey

- social media posts and e-mail messages to seek participation from Indigenous and women entrepreneurs in the sector

- messages sent to key research universities across Canada

- engagement with the Canadian Agricultural Youth Council (CAYC), a consultative body to Agriculture and Agri-Food Canada

- messages sent to CFIA email notification subscribers

Results

During the 60-day consultation between January 18 and March 19, 2021, the CFIA received:

- 1,400 views/clicks on the online survey

- 800 written responses to the 4 key consultation questions asked in the online survey (200 each)Footnote 1

- 27 written submissions via e-mail

The feedback summarized in this report was gathered from all of these sources, in addition to comments received at webinars. It appears in no particular order, and is presented as it was received from stakeholders to minimize misinterpretation.

Main themes

5 main themes emerged from feedback received during this consultation, which is further organized into sub-themes. These are displayed below, and are discussed in detail in the next 5 sections.

- Theme 1 – International alignment and harmonization

- Theme 2 – Domestic coordination

- Theme 3 – Program and service delivery

- Theme 4 – Pre-market requirements and approval processes

- Theme 5 – Tailored supports for small, medium-sized, and Indigenous businesses

Theme 1 – International alignment and harmonization

Stakeholders were clear: Canada's regulatory system for agricultural and agri-food products must be better harmonized with those of key trading partners, including the elimination of non-tariff trade barriers.

Deepening international partnerships to promote science-based decision-making and alignment of standards, procedures, and enforcement was also highlighted as the key to gaining market access.

- Increase alignment of regulations and programming to facilitate international market access

- Support innovators to compete globally

Increase alignment of regulations and programming to facilitate international market access

The regulatory environment in different jurisdictions and related costs of compliance have an impact on business decisions, especially for small and medium-sized enterprises (SMEs).

There was a strong push to better align and coordinate Canadian requirements with those of key trading partners and to more closely consider the international landscape, such as using globally-accepted requirements and standards when making new regulations.

Stakeholders recommended the following distinct areas of focus to promote alignment with international regulations and programming and to help the Canadian agriculture and agri-food sector to gain market access.

Agreements and technical cooperation

- prioritize Mutual Recognition Agreements (MRAs) between Canada and other countries to support Canadian-made products and Canadian businesses' abilities to export

- renew efforts to develop a Canada-U.S. Perimeter Strategy as per the 2011 Declaration on a Shared Vision for Perimeter Security and Economic Competitiveness to facilitate trade, economic growth, and address threats early, such as the spread of invasive pests

- develop zoning agreements recognized by trading partners to allow resumption of trade in an event of a foreign animal disease

- address technical issues preventing access to the Chinese market for Canadian poultry and egg products due to highly pathogenic avian influenza (H5N1) virus restrictions

- discuss with key export partners how to achieve greater harmonization and ensure clarity around regulations and trade policies for SMEs that face resource pressures.

- negotiate more equivalency agreements with other countries for organics

Regulatory harmonization: general

- update regulations on genomics, proteomics such as protein quality testing requirements and food nanotechnology to ensure alignment with other international regulatory requirements

- harmonize labelling requirement for proteins and nutrient content claims between Canada, U.S., Europe and Australia

- align and streamline regulations that apply to facilities that are certified by the CFIA:

- facilities that import and export products must comply with federal requirements

- incremental costs related to regulatory compliance for these facilities can be prohibitive, especially for SMEs

- align oversight related to packaging types

- review regulations on pests and bio-pesticides, including but not limited to maximum residue limits, with a goal to harmonize the requirements set out by our major trading partners

- align organic requirements:

- for example, conducting regular, publicly-funded reviews every 5 years of the Canada Organic Regime (COR)

"Increasing market access includes aligning to other countries for both exported and imported products, specifically with key trading partners. This provides increased confidence throughout the food industry to sell goods with ease in either jurisdiction and helps minimize product development costs."

Regulatory harmonization: specific requirements

The following, specific areas were highlighted as priorities for harmonization:

- regulations related to enrichment, such as wheat flour

- lot codes for produce and other commodities

- priority allergens and statements

- contaminant levels for products such as pesticides and food additives

Regulatory approvals

- increase recognition of product testing, reviews and approval processes from other jurisdictions to avoid duplicative sampling and testing requirements, and delays in getting products to market

- consider adopting ingredient acceptance practices such as the Generally Recognized as Safe (GRAS) process in the United States

- this could serve as a model to improve transparency on ingredients and additives that have been already evaluated by experts, and are recognized as safe when used as intended

- incorporate cost considerations as part of the approval for veterinary drugs, notably the variance in costs between Canada, United States, Europe and China

Program delivery

- align timing and communication of corrective actions related to outbreaks, advisories and recalls with other jurisdictions

- coordinate same-time announcements and notices to industry in Canada and the United States

- work with additional trading partners to negotiate similar approaches to the CFIA's Authorized Importer (AI) Program and the Canadian Phytosanitary Certification Program for Seeds (CPCPS)

- these can "provide industry with more independent flexibility" by delegating it the authority to perform certain functions to streamline commerce at the border

- use the same laboratory methodologies as trading partners, especially when testing results will be used for enforcement purposes

Support innovators to compete globally

Many comments spoke about approval processes for new plant breeding technologies and new/novel feed ingredients. We heard that our approval processes are not supporting innovators to keep pace in these highly competitive areas with competitors around the world.

For example, asymmetrical approvals of new/novel products, whereby these products are approved in other jurisdictions but not in Canada, can lead to trade barriers and increased costs for Canadian businesses.

Improving partnerships to address these barriers and accepting decisions made by trusted foreign regulators were mentioned as key ways to promote innovation, growth and competitiveness.

Suggestions to further facilitate international market access for new/novel products included the following:

- speed up approvals for products that are regulated in other countries and have already been approved – there is "no need to reinvent the wheel"

- avoid any "uniquely Canadian requirements" and support regulatory reform

- better align with the U.S. by relaxing regulations on agricultural innovations resulting from plant genome editing and consider different approaches to adopting gene-editing technologies used by other countries to increase access to new technologies for Canadian farmers

These suggestions focus on international alignment, however we received significant comments on all aspects of pre-market approvals. Additional feedback on this topic is summarized in Theme 4.

"Canada is the only country in the world to subject conventional plant breeding to the same type of pre-market safety assessments that other countries apply only to genetically-modified organisms. Not only does this lack of alignment place Canadian innovators at a disadvantage, it makes it more difficult for Canada to partner with like-minded countries to advocate for global regulatory alignment in support of predictable trade."

Theme 2 – Domestic coordination

To foster a clear, predictable regulatory environment for industry that is conducive to growth, further coordination across all levels of government and between federal departments is needed.

Feedback received consistently emphasized the importance of addressing interprovincial trade barriers, reducing duplication between federal, provincial and territorial (FPT) requirements, and working together to highlight the quality and value of Canadian-made products.

- Work with all levels of government to address interprovincial trade barriers and achieve domestic equivalency

- Employ a whole of government approach to regulation

- Promote products made in Canada and protect the Canadian brand

Work with all levels of government to address interprovincial trade barriers and achieve domestic equivalency

There were strong calls for federal, provincial and territorial governments to:

- address internal barriers to market access, including those already identified in the 2017 reports from the Advisory Council on Economic Growth (the Barton Report) and the Economic Strategy Table Reports for the agriculture and agri-food sector

- continue to follow the 7 regulatory guiding principles and priorities set by FPT agriculture ministers in 2019, in particular:

- consistent interpretation, delivery and enforcement of regulations across jurisdictions

- accelerate economic recovery following the COVID-19 pandemic, and ensure that regulations facilitate internal and international trade while fulfilling public policy objectives

Comments emphasized eliminating duplication and redundancies, ensuring equivalence of foreign standards against Canadian standards, and working together when developing and implementing policies and regulations to reduce the burden on industry.

More specifically:

- develop a national food safety strategy that would align all FPT requirements and apply to all food operations, regardless of size or location

- develop processes or agreements such as Memoranda of Understanding (MOUs) with PTs to streamline inspections and make more efficient use of inspection resources while reducing burden on regulated parties

- seek regulatory equivalence between domestic and imported foods and reduce any disproportionate compliance and enforcement efforts on domestic products relative to imports

- continue existing efforts on the Domestic Comparability Assessment Tool (DCAT) to enhance and expand interprovincial red meat sales

- solicit more input and support from the provinces and territories on levelling the playing field for new/novel products, via the FPT Regulatory Agility Sub-CommitteeFootnote 2

"Domestic food producers are held to a higher standard, yet have to compete against food produced in jurisdictions that have lower regulatory burdens and that have access to lower input costs and inputs not available in Canada."

Employ a whole of government approach to regulation

We heard that fully enabling greater competitiveness, innovation, and inclusive economic growth in the agriculture and agri-food sector requires greater coordination amongst numerous federal departments and agencies that regulate and deliver programs and services to the sector.

Emphasis was placed on taking a whole of government approach to enhance collaboration with other regulators and departments when developing new requirements.

Specific suggestions are as follows:

Coordination at the federal level

- prioritize meeting trade and market access objectives by working more closely with Agriculture and Agri-Food Canada's (AAFC's) Market Access Secretariat, the Canadian Trade Commissioner Service at Global Affairs Canada, and Export Development Canada

- mandate the requirement for regulatory efficiency, economic growth, and adopt a coordinated approach to reviewing regulations

- this is expected to result in a more global assessment of cost, complexity and administrative burden on industry

- instead of disrupting businesses with a series of disjointed changes proposed by the federal regulators within a short period of time, ensure coordination to minimize disruptions in production

- better leverage existing industry-government initiatives such as AAFC's Agile Regulations Table

"The CFIA needs to work across government to ensure that regulatory requirements being imposed are consistent and fall within similar timelines."

Coordination within the federal agriculture portfolio

- reconvene former consultative and advisory committees including the Organic Value Chain Roundtable, Canada Organic Office and the External Advisory Committee on Regulatory Competitiveness

- work with other government departments to recognize programs associated with CFIA's Food Safety Recognition Program (FSRP) as broadly meeting regulatory requirements to increase predictability and reduce duplication and administrative burden for Canadian farmers

- include the organic sector at discussion tables such as the Seed Regulatory Modernization working group

Coordination between CFIA and Health Canada

- improve communication between CFIA and Health Canada to ensure that new regulations are consistent, not duplicative, and that related requirements can be implemented by industry on similar timelines

- for example, the 2021 Health Canada and CFIA Consultation on Proposed Joint Policy Statement on Food Labelling Coordination was cited as a model strategy in coordinating future changes to food labelling requirements

- create a central, one-stop platform to publish information from both CFIA and Health Canada, including Notices of Proposal and Notices of Modification, to clearly communicate all proposed or recent changes to industry

- organize departmental documents that have been incorporated by reference so that they are more readily accessible from a single location

"To reduce the burden and associated costs, the timeframe to comply with new regulations should be appropriate not only in duration but must also minimize disruption to the supply chain. Both considerations are essential to reducing burden on industry..."

Promote products made in Canada and protect the Canadian brand

There were calls for more action to promote and protect Canada's high food safety standards and support increased capacity for processing more products domestically to facilitate market access. Suggestions received were as follows.

- finalize the "Brand Canada" marketing, "Product of Canada" labelling, and Product of Canada claims initiatives to strengthen the competitiveness of domestically-produced food and Canadian industry

- regulate use of the "Canada Organic Label"/Canadian organic logo

- re-instate a standards interpretation committee for organics

- "self-promote Canadian produced foods" by increasing market access for provincial producers by removing surcharges to export products

- encourage purchasing of Canadian-made products and small-scale Canadian production, and promote locally-made goods through joint CFIA-industry initiatives

- create an exemption to current dairy requirements to allow for the sale of raw, unpasteurized milk products

"… [CFIA should] collaborate with other agencies and highlight the superior quality (from farm to table) as well as the nutritional value of Canadian grown grains, oilseeds and crops."

Theme 3 – Program and service delivery

There is an urgent need to continue to improve CFIA's services and program delivery, including increasing responsiveness, digitization, streamlining program delivery and enhancing the consistency of compliance and enforcement.

For example, stakeholders clearly stated that the CFIA occasionally takes several weeks or months to respond to their questions. This delay acts as a deterrent, and was cited as a key cost that impacted business opportunities both within Canada and internationally.

In addition, increased momentum to adopt more modern business and information management practices caused by the COVID-19 pandemic must be sustained, or increased. CFIA has been called upon to continue to implement electronic platforms to increase the accessibility and transparency of its processes.

- Reduce administrative delays

- Digitize services

- Collaborate with trusted third parties to deliver programs and services

- Clear and consistent compliance and enforcement

Reduce administrative delays

We heard about the need to reduce administrative delays linked to manual, paper-based processes, improve response times to questions from stakeholders, and:

- ensure a timely response to other countries that request information on export-related documents

- implement an online tracking system for reviews and approvals

- streamline requirements for health certificate processes for export markets in dairy and applications for imports

- address lengthy wait times for seed variety registration

- have resources available on the ground and equipped to answer regulatory questions

- improve the accessibility of guidance documents on the CFIA website

"One of my own requests for clarification took eleven months for a response, and the response was "no, we don't do that", causing additional consternation."

Digitize services

There was strong support for CFIA to continue to increase its offering of online services, especially digital delivery of documents required to gain market access. More specifically:

- digitize financial transactions and certificates

- Canada lags behind the United States in delivering electronic phytosanitary certificates, which places the seed and grain value chain at a competitive disadvantage

- simplify and digitize the registration process for fertilizer in Canada to reduce delays

- stakeholders mentioned experiencing backlogs of "up to 8 months in fertilizer and supplement registration reviews", which significantly hinders market access for the sector

- explore using blockchain ledger technology to "protect the integrity of Canadian products" through improved traceability

- additionally, align regulatory efforts and explore blockchain technology with other countries to enhance transparency and reduce risk

- it is crucial for stakeholders to be engaged early and often to be prepared for eventual implementation of this technology

- include organic import requirements in the CFIA's Automatic Import Reference System (AIRS)

- continue the work of issuing online export certificates through the MyCFIA platform and work towards consistency and integration across all Government of Canada systems

"Paper hard copy phytosanitary certificates are still provided to seed companies, and the receipt of them by the seed company is still manual."

Collaborate with trusted third parties to deliver programs and services

Many comments requested more clarity around private certifications, trusted trader programs, alternative service delivery, and their resulting impacts on the frequency of CFIA oversight.

Specific suggestions are to:

- employ alternate service delivery in areas such as digital logistics, customs processes, and pre-approved digital customs paperwork to expedite service and facilitate trade

- Clarify third-party certification schemes. For example:

- by showing how they assist participants to comply with regulatory requirements

- whether participation in these schemes impacts the level of CFIA's regulatory oversight

- recognize investments made in third-party certifications, and access to related third-party certification schemes

- examine redundancies in certification requirements between private food safety programs recognized by the CFIA, such as the CanadaGAP program for fruits and vegetables, and the requirements under the Safe Food for Canadians Regulations (SFCR)

- expand other food safety programs that are similar to CanadaGAP, such as the Canadian Partners in Quality Program (C-PIQ)

- this program provides an integrated inspection system as an alternative to the traditional, hands-on inspection by the CFIA for table-stock potatoes exported to the U.S.

- grow the CFIA's Authorized Importer (AI) Program and the Canadian Phytosanitary Certification Program for Seeds (CPSPS) to further facilitate the import of international seed and export to the U.S.

- continue to explore flexibilities in the applications of standards, such as the Restricted Feeder Cattle Program that reduces burden by allowing animals to be imported into Canada from the U.S. without test requirements provided certain conditions are met

Clear and consistent compliance and enforcement

Several comments emphasized the need for CFIA to address existing issues related to consistent and fair compliance and enforcement. We received the following recommendations:

- provide more training for CFIA inspectors and industry on new regulatory requirements

- inconsistent inspection practices, interpretation and application of regulations, and slow response times from CFIA can be costly for businesses and impact their competitiveness in domestic and foreign markets alike

- provide additional transparency around the compliance of imported products

- address issues related to fraudulently labelled imports that threaten domestic production and market access (for example, imported chicken that is declared as "spent fowl" to bypass import controls)

- acquire capacity to test imported and exported products against a recognized standard to verify product integrity

- establish microbiological criteria for food products to reduce ambiguity and provide additional guidance to SMEs

- promote and enforce federal standards of identity for dairy products as well as their common names

- seek to correct a perceived imbalance in enforcement by CFIA between "pedigree and common seed"

- this imbalance affects royalties and investments in breeding tied to pedigree seed

Theme 4 – Pre-market requirements and approval processes

Pre-market requirements and approvals, including prioritization of approvals for new/novel products, were areas highlighted as requiring immediate attention.

Significant feedback received underscored the need to further streamline and clarify regulatory requirements, seek consistency with international partners, and create a clearer, more predictable regulatory environment to support the research and development of new/novel products.

- Improving service standards and predictability

- Prioritizing approvals of new/novel products in Canada

Improving service standards and predictability

Regulators need to provide certainty to industry on their service standards for new/novel products and work to clarify and streamline burdensome pre-market regulatory requirements.

To achieve this, we heard there is a need to:

- provide predictability in pre-market authorizations for innovations through clear submission guidelines for plants and animal feed, particularly those involving new genomic technologies

- these factors continue to inhibit industry's ability to access seed varieties and innovative plant health products

- Canada is falling behind countries such as Japan, Australia, New Zealand and the United States in terms of supporting its industry's ability to compete globally

- increase turnaround times to register new/novel products: for example, oat derivative product registration

- Left unaddressed, products developed in Canada end up being manufactured in other countries

- provide clearer guidance about new/novel products and improve response time for questions

- establish service standards based on risks posed by new/novel products

- implement a service standard requiring that phytosanitary certificates be issued a maximum of 5 days from the time the online application is received, depending on testing requirements and destination

- create a mechanism for industry to seek independent examination and/or redress if regulatory issues arise that impact the progress of an application

Prioritizing approvals of new/novel products in Canada

Stakeholders said that approval processes, especially for new plant products and new/novel feed ingredients, need to keep pace with the marketplace and investments are needed to speed up these processes. They mentioned that in their view, the COVID-19 pandemic has made existing issues with slow approvals even more difficult.

We asked whether stakeholders would support prioritizing approvals of certain new/novel products that CFIA regulates, while considering the need to maintain a level playing field for industry.

Support for regulatory prioritization

In general, we learned that there is moderate support for prioritization.

Specific areas mentioned where it could be considered were:

- reassessing the need for pre-market safety assessments for plants with new/novel traits

- removing this requirement for conventional breeding products would incentivize and assist small and medium-sized enterprises (SMEs) and Indigenous peoples in the sector to innovate and develop new products

- approvals related to pest and disease mitigation

- production of value-added products to meet changing consumer and market needs for convenience, including those produced by the fisheries sector

In addition to support: caution

While there were general, strong expressions of support for prioritization of new/novel products, especially those that are registered and have a history of safe use in other countries, some stakeholders cautioned that market access for existing products should remain a priority.

Additional concerns were raised that prioritizing new/novel products could mean that genetically modified organisms (GMOs), Clustered Regularly Interspaced Short Palindromic Repeats (CRISPR) gene editing technology, and other targeted breeding techniques would be prioritized over traditional methods of food production.

If prioritization is pursued, we heard it is important to continue to:

- maintain and expand market access for existing, approved products as well as the need for more deregulation in-step with prioritization, while adhering to strong standards and oversight of food safety

- respect established labelling rules and norms, and ensuring that existing and new products are equally supported by CFIA

- for example, ensuring that plant-based substitutes for meat products are appropriately and truthfully labelled

- maintain access to necessary products, and not causing unnecessary supply chain disruptions

- recognize that additional CFIA resources may be needed to support related, effective compliance and enforcement activities

- be fully transparent, and ensure all stakeholders in the sector have the same information

Levelling the playing field

Stakeholders expressed the need for further engagement to confirm what the third consultation question meant by a "level playing field"; noting that in their view, a level playing field means that regulatory prioritization efforts should:

- prioritize CFIA's regulatory activities to better align with the principles of supporting a competitive economy through inclusive economic growth, entrepreneurship, and innovation as required by the Cabinet Directive on Regulation

- provide "additional freedom and flexibility in the definition of crops" to address concerns with the variety registration system and build partnerships to distinguish Canadian crops from other "mass marketed" commodities

- create more clarity and flexibility around labelling, as well as a fair environment for traditional commodities to better facilitate market access for plant based alternatives, new/novel proteins, and farm inputs, including fertilizers

Development of a mutually-beneficial approach would ideally be undertaken as part of open, collaborative discussions between the CFIA and regulated parties on criteria for prioritizing new products and developing a mutually-accepted definition of a "level playing field."

Theme 5 – Tailored supports for small, medium-sized, and Indigenous businesses

Throughout the consultation, stakeholders representing small and medium-sized enterprises (SMEs) frequently expressed views that they greatly contribute to innovation in the agriculture and agri-food sector but face challenges due to their resources, which are more restricted than larger producers. Therefore, SMEs need more engagement, guidance, education, and support from the CFIA and key exporting partners to better understand regulations and trade policies.

- Supporting Canada's small and medium-sized enterprises (SMEs)

- Culturally competent approaches to advance Reconciliation and support Indigenous businesses

Supporting Canada's small and medium-sized enterprises (SMEs)

We heard the need for CFIA to provide more guidance to industry to help clarify and improve understanding on various regulatory requirements and programs, and engage meaningfully with stakeholders to find new ways to reduce the regulatory burden on industry.

There was strong support for helping SMEs with understanding trade, regulations, and regulatory requirements as they often lack in-house resources and expertise. Ensuring that they have a voice during CFIA consultations is also important in order to reflect their needs in the agency's programs and services.

We heard that providing this support and increasing services for SMEs both online and from CFIA offices across Canada would significantly help reduce barriers to growth and innovation for these companies.

Specific suggestions were to:

- create a service-oriented group within CFIA to assist SMEs and other underrepresented groups with regulatory compliance

- help food SMEs with difficulties understanding how regulations and the Safe Food for Canadians Regulations apply to them

- hold information sessions on market access requirements to help SMEs better anticipate potential challenges and issues

- collaboratively develop market-specific strategies to help SMEs expand their reach across provinces

- improve support for businesses to navigate regulatory processes, and enable "transparency, pathfinding, and capacity-building" in individual sectors

- continue to consult with stakeholders pre-emptively on potential market access issues

- for example, restrictions and new requirements that were placed on imports by some countries as part of their response to the COVID-19 pandemic

- consult more with industry on label changes, on a sector-by-sector basis

- allow sufficient time for stakeholders to participate in consultations

- a 30 to 60 day consultation period is inadequate for informed input by many industry associations, as they need more time to engage their members

- assist with the costs for SMEs to certify organic, which will help them to meet the growing demand for organic products

"Be an ally for small companies on the world stage. This can be done through transparency and an effort to build mutual trust with trading partners and consumers."

Culturally competent approaches to advance reconciliation and support Indigenous businesses

Stakeholders mentioned that CFIA needs to improve outreach and engagement with Indigenous peoples, many of which face unique barriers and are relatively new to commercial agriculture.

To ensure proper understanding, it was emphasized that this engagement would need to be conducted at the community level, and approaches should be co-developed with Indigenous communities, businesses and entrepreneurs.

Specific recommendations received are below, and are grouped under 2 main areas: creating opportunity through reconciliation, and providing culturally-competent support for Indigenous businesses.

Creating opportunity through reconciliation

- explore how traditional Indigenous knowledge can support risk management and food safety, using approaches such as "two-eyed seeing" which bring together the strengths of both Indigenous and mainstream knowledge to meet expected outcomes and comply with regulatory requirements

- begin to bridge existing gaps exacerbated by the COVID-19 pandemic by strengthening and building capacity in the food supply chain in northern, rural, and/or isolated communities, in partnership with provincially-inspected food processors

- examine whether Aboriginal rights are recognized in CFIA policies

- specifically, seek increased clarity on how assertion of self-governance of Indigenous peoples and self-licensing in Indigenous aquaculture operations harmonizes with the current regulatory environment

- increase dialogue around food used for traditional, social and ceremonial purposes to "understand future market potential and barriers to trade"

- incorporate measures in CFIAs import and export programs to help protect Indigenous people and native forests

Culturally-competent support for Indigenous businesses

- partner with band council offices and Indigenous-run associations before launching consultations to make sure that the language is appropriate, culturally sensitive and translated into regional dialects

- recognize the uniqueness of individual Indigenous communities

- apply a distinctions-based approach to policy development and building nation to nation and government to government relationships to support Indigenous peoples with agricultural operations

- work with other federal departments and agencies, including Indigenous Services Canada, Health Canada, and Agriculture and Agri-Food Canada, to deliver inspections and develop programs that support Indigenous peoples in the sector

- make special considerations for First Nations living on-reserve, and improve access to assurance and inspection programs through more proactive outreach, information sharing, and concierge-style services

- support existing industry and economic development resources in the private and non-profit sector to help SMEs and Indigenous entrepreneurs

- create a separate stream for traditional healing products, including laboratory and testing support

"Working within risk frameworks takes "Two Eyed Seeing", understanding that traditional knowledge and traditional food gathering methods can interface in a safe and compliant way when proper dialogue and understanding takes place…"

Participant demographics

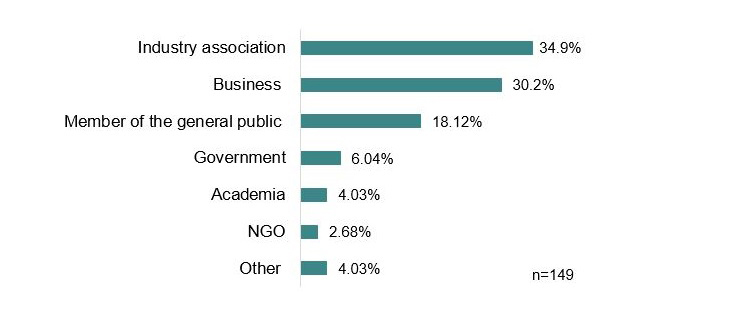

Figure 1. Bar chart showing participation in the online survey by stakeholder profile. The graph shows that 2/3rd of online participants who completed the demographics questionnaire identified as businesses and industry associations.

Description for Survey participation by stakeholder profile

| Stakeholder | percentage |

|---|---|

| Industry association | 34.9% |

| Business | 30.2% |

| Member of the general public | 18.12% |

| Government | 6.04% |

| Academia | 4.03% |

| NGO | 2.68% |

| Other | 4.03% |

n=149 (number of responses to the question)

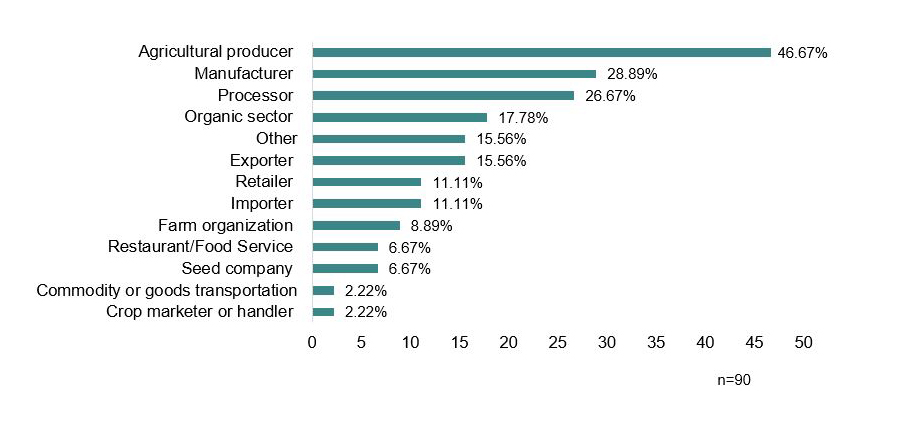

Figure 2. Bar chart showing business type of participants who identified as representing a business. Nearly half identified as agricultural producers.

Description for Survey participation by business type

| Business type | percentage |

|---|---|

| Agricultural producer | 46.67% |

| Manufacturer | 28.89% |

| Processor | 26.67% |

| Organic sector | 17.78% |

| Other | 15.56% |

| Exporter | 15.56% |

| Retailer | 11.11% |

| Importer | 11.11% |

| Farm organization | 8.89% |

| Restaurant/Food service | 6.67% |

| Seed company | 6.67% |

| Commodity or goods transportation | 2.22% |

| Crop marketer or handler | 2.22% |

n=90 (number of responses to the question)

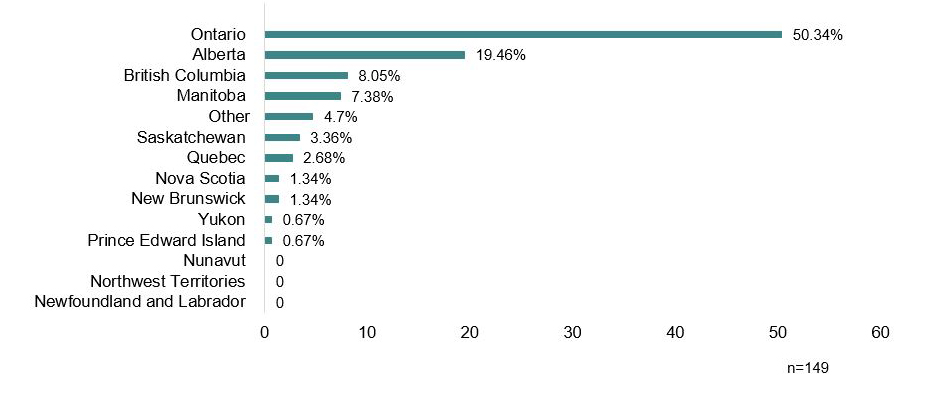

Figure 3. Bar chart showing participation in the online survey by province or territory.

Description for Survey participation by geographical location

| Geographical location | percentage |

|---|---|

| Ontario | 50.34% |

| Alberta | 19.46% |

| British Columbia | 8.05% |

| Manitoba | 7.38% |

| Other | 4.7% |

| Saskatchewan | 3.36% |

| Quebec | 2.68% |

| Nova Scotia | 1.34% |

| New Brunswick | 1.34% |

| Yukon | 0.67% |

| Prince Edward Island | 0.67% |

| Nunavut | 0% |

| Northwest Territories | 0% |

| Newfoundland and Labrador | 0% |

n=149 (number of responses to the question)

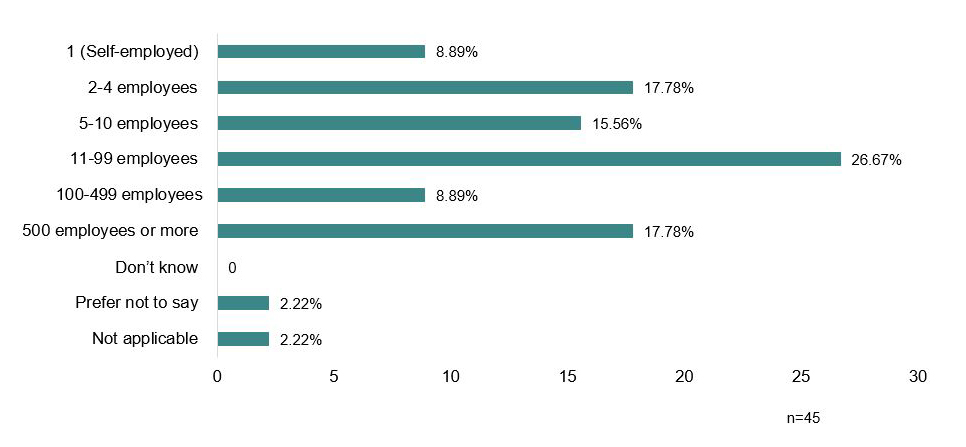

Figure 4. Bar chart showing number of employees of participants who identified as representing a business. Almost 80% of participants who answered this question represented a small or medium-sized enterprise (SME).

Description for Business survey participants by number of employees

| Number of employees | percentage |

|---|---|

| 1 (self-employed) | 8.89% |

| 2 to 4 employees | 17.78% |

| 5 to 10 employees | 15.56% |

| 11 to 99 employees | 26.67% |

| 100 to 499 employees | 8.89% |

| 500 employees or more | 17.78% |

| Don't know | 0% |

| Prefer not to say | 2.22% |

| Not applicable | 2.22% |

n=45 (number of responses to the question)

Next steps

All feedback summarized in this report will be analyzed and used to inform future efforts to further enable competitiveness and innovation in the agriculture and agri-food sector.

Thank you

The CFIA would like to thank all participants who contributed their time, resources and insights to this process. Your contributions during the current COVID-19 pandemic, a time of unprecedented hardship for many Canadians and Indigenous peoples with connections to the Agriculture and Agri-Food industry, is recognized and appreciated. With your assistance, the CFIA is committed to helping build an even stronger, more competitive, and more resilient sector that will continue to serve Canadians and stakeholders internationally.

Feedback about this report

Write us at: cfia.programpolicy-politiqueprogramme.acia@inspection.gc.ca