Date: August 29, 2023

On this page

- Canadian Food Inspection Agency (CFIA) Overview Briefs

- Key Functions

- Hot issues

Canadian Food Inspection Agency (CFIA) Overview Briefs

About the CFIA

Mission: Dedicated to safeguarding food, animals and plants, which enhances the health and well-being of Canada's people, environment and economy.

Core responsibilities

- Food Safety: Safeguard Canada's food supply, minimize health and safety risks to Canadians and contributes to consumer protection

- Plant Health: Protect Canada's plant resource base, environment, and plant-related industries

- Animal Health: Protect Canada's animal resource base and Canadians from diseases, minimize risks to Canada's terrestrial and aquatic animal resource base, and ensure the safety of animal feeds, products and vaccines

- International Trade: Facilitate market access for Canada's plants, animals, and food, as well as contribute to market access for Canadian agriculture and agri-food

Legislative mandate

Develop and deliver inspection and other services to:

- Prevent and manage food safety risks (e.g., food recalls)

- Protect plant resources from pests, diseases, and invasive species (e.g., emerald ash borer)

- Prevent and manage animal diseases (e.g., African swine fever (ASF), bovine spongiform encephalopathy (BSE), chronic wasting disease (CWD), etc.), which sometime also threaten human health (e.g., avian influenza)

- Contribute to consumer protection (e.g., labelling claims, food fraud)

- Facilitate market access for Canada's food, plants, and animals

- Conduct innovative research to make science-based decisions

Division of responsibilities

Minister of Health

Responsible for:

- Overall direction of the CFIA

- Establish policies and standards related to the safety and nutritional quality of food sold in Canada and assess the effectiveness of the Agency's activities related to food safety

- Food safety:

- Food and Drugs Act

- Safe Food for Canadians Act

Minister of Agriculture and Agri-Food

Responsible for:

- The non-food safety legislation administered and enforced by the CFIA, including the facilitation of market access, animal health and plant protection

- The administration and enforcement of the Agriculture and Agri-Food Administrative Monetary Penalties Act and the following:

- Plants: Fertilizers Act, Plant Protection Act, Seeds Act and Plant Breeders' Rights Act

- Animals: Feeds Act and Health of Animals Act

- Non-food safety: Safe Food for Canadians Act and Food and Drugs Act

CFIA resources (in millions)

Description for CFIA resources chart

| Core Type of Expenditure | Core Planned Spending | % |

|---|---|---|

| Safe Food | $373M | 45% |

| Internal Services | $171M | 20% |

| Animal Health | $148M | 18% |

| Plant Health | $129M | 15% |

| International | $17M | 2% |

| Type of Expenditures | Core Planned Spending | % |

|---|---|---|

| Operating Expenditures (87% pay and 13% non-pay) | $645M | 77% |

| Other Statutory | $97M | 12% |

| Statutory Revenue | $53M | 6% |

| Capital Expenditures | $43M | 5% |

Total resources: Budget of $838 million

CFIA National Presence

Description for CFIA National Presence chart

- Western Area (FTE: 1,945)

- Manitoba (Winnipeg)

- Alberta South (Calgary)

- Alberta North - Saskatchewan (Edmonton)

- British Columbia (Burnaby)

- Ontario Area (FTE: 1,331)

- Northeast (Barrie)

- Toronto (Downsview)

- Central (Guelph)

- Southwest (London)

- NCR Area (FTE: 2,095)

- Quebec Area (FTE: 1,197)

- Montreal East

- Montreal West

- St. Hyacinthe

- Ste. Foy

- Atlantic Area (FTE: 936)

- New Brunswick (Moncton)

- New Brunswick (Fredericton)

- Prince Edward Island (Charlottetown)

- Newfoundland and Labrador (St. John's)

- Nova Scotia (Dartmouth)

13 laboratories: Atlantic (2), Quebec (2), Ontario (3), Western (6)

Key CFIA partners

- Provincial and Territorial governments (primarily Health and Agriculture departments)

- Federal Departments and Agencies (e.g., Environment and Climate Change Canada [ECCC], Global Affairs Canada [GAC], Fisheries and Oceans Canada [DFO], Canada Border Services Agency [CBSA])

- Industry (e.g., Canadian Meat Council, Dairy Farmers of Canada, Canadian Produce Marketing Association, Canadian Poultry and Egg Producers Council, Food, Health and Consumer Products of Canada)

- Non-government organizations (e.g., Justice for Animals, Équiterre)

- International Trading Partners (e.g., U.S., China, E.U., India)

- Consumers

Key Functions

Emergency Management at CFIA

Mandate on Emergency Response

The CFIA is responsible for the management of two types of emergencies:

- Mandate-specific (food safety, animal or plant health emergencies) and

- Non-mandate-specific (infrastructure or other public welfare emergencies)

CFIA activates an emergency response plan when the required response is expected to exceed normal operational capacities or is particularly complex and requires enhanced coordination and communication.

Emergency Management Framework

Description for Emergency Management Framework

In the CFIA Emergency Management Framework, once an emergent threat is identified the Agency can take action to Prevent & Mitigate it. The next step is to Prepare, and if the emergency event is realized, Respond. Following the response, the agency will Recover, and simultaneously feed back into preparing for the next event. This cycle repeats, and throughout all steps there is collaboration with CFIA's Federal, Provincial, Territorial and Industry stakeholders.

- Prevent and Mitigate: Border controls, vaccination and other tools/strategies

- Prepare: Table top / simulation exercises, clear roles and responsibilities, hazard specific plans, area response networks

- Respond: Use of Incident Command Structure (ICS) and national/regional emergency operations centres, communication and information sharing, international efforts

- Recover: Compensation to affected producers, international negotiations, support through funding, diversify efforts

Key Stakeholders and Roles in an Emergency

Emergency response requires multiple different organizations to work alongside each other effectively. In a federally reportable disease controlled by the CFIA, the CFIA is considered to be a primary stakeholder with overarching legislative authority for the disease response measures. Other key stakeholders:

- Federal, Provincial and Territorial (FPT) Partners: Provincial agriculture and health ministries (animal welfare, on farm/landfill environmental jurisdiction, epidemiology), public health units (epidemiology, recall check support), and federal partners (Agriculture and Agri-Food Canada [AAFC]: producer/industry support; ECCC: wild population information, Health Canada and the Public Health Agency of Canada [HC/PHAC]: risk assessment and epidemiology for food; etc.)

- Industry Stakeholders: National and provincial industry associations (e.g., Feather boards and poultry producer associations, Canadian Pork Council, Canadian Cattle Association, Horticultural council, Retail Council of Canada, Animal Health Canada, etc.) support effective communication with members, information sharing and preparedness/recovery efforts.

- Indigenous Groups: CFIA conducts peacetime outreach to indigenous groups and maintains an indigenous liaison officer during emergency response with an effort to effectively communicate, migrate impacts and respect federal obligations (e.g. control zones overlapping with reserve territory, or species management impacting traditional hunting grounds).

- Scientists / researchers: Detection and surveillance, epidemiology, analysis and development of new scientific methods

- Consumers / public: Clear communication during all stages of the emergency is necessary to inform consumers, provide any required direction and instill confidence

Past and Current Emergency Responses

- Highly Pathogenic Avian Influenza: 2014 (British Columbia), 2015 (Ontario), 2016 (Ontario), 2022/23 (National)

- Bovine spongiform encephalopathy: 2015 (Alberta), 2021 (Alberta)

- Oak Wilt: 2023 (Ontario)

- Potato Wart: 2021 (Prince Edward Island)

- Bovine Tuberculosis: 2016 (Alberta), 2018 (British Columbia), 2023 (Saskatchewan)

- Asian Longhorned Beetle: 2013 (Ontario)

Case Study: 2022-23 Avian Influenza Outbreak

- Detection: First detected in wild birds in Newfoundland (Dec 2021), before spreading throughout Canada in 2022 (all provinces except PEI)

- Response: Over 7.6 million domestic birds affected, 322 Infected Premises (IPs) and more than 2,000 CFIA employees

- Recovery: Over $135M paid in compensation to producers to date

- Lessons learned: Key lessons are emerging related to destruction activities, compensation delivery, industry engagement, roles and responsibilities and information sharing.

- Prevention and Preparation for the future: Increased surveillance and One Health collaborative approach is required due to potential for spread in mammals

CFIA Program Delivery

The CFIA's programs deliver on the Agency's mandate to help ensure food is safe and accurately represented to Canadians, that plant and animal resources are protected from pests and disease and are safe for Canadians and the environment, and that food, plant and animal products can be traded internationally.

Delivering our services across Canada

Description for Delivering our services across Canada

| Area | Regions included | Head count |

|---|---|---|

| Atlantic Area |

|

936 |

| Quebec Area |

|

1,197 |

| NCR Area | National Capital Region | 2,095 |

| Ontario Area |

|

1,331 |

| Western Area |

|

1,945 |

CFIA's laboratory network

Western lab network (172 FTE)

- Sidney (Plant Health)

- Burnaby (Food Safety)

- Calgary (Food Safety)

- Saskatoon (Animal Health, Food Safety, Plant Health)

Eastern lab network (171 FTE)

- Longueuil (Food Safety)

- Saint-Hyacinthe (Animal Health, Food Safety)

- Charlottetown (Plant Health)

- Dartmouth (Food Safety)

Ontario lab network (231 FTE)

- Greater Toronto Area (Food Safety)

- Ottawa Fallowfield (Animal Health, Food Safety, Plant Health)

- Ottawa Carling (Animal Health, Food Safety, Plant Health)

National Centres for Animal Disease (123 FTE)

- Lethbridge (Animal Health)

- Winnipeg (Animal Health)

National Headquarters (215 FTE)

Our stakeholders

Domestic

- Regulated parties

- Farmers, producers, processors, operators, plant breeders, growers, importers and exporters, transporters

- Partners

- Provinces and territories

- Government partners (e.g., AAFC, PHAC, HC, etc.)

- Indigenous businesses, leaders and communities

International

- Trading partners, foreign competent authorities, international standard setting bodies

CFIA Program Development

- Sets rules and regulatory framework: CFIA develops the Acts and Regulations governing food safety, animal health, and plant health, and continuously seeks opportunities to optimize its regulatory framework.

- Provides advice and guidance: CFIA provides guidance to industry and the Inspectorate, strategic advice in relation to legislation, and direction based on risk management activities to inform CFIA's risk-based decision making.

- Ensures compliance verification and promotion: CFIA designs inspection and enforcement programs and conducts educational and awareness campaigns to support industry compliance and public awareness.

- Establishes permission requirements: CFIA is responsible for permissions, such as permits, licences, certificates, approvals, and their requirements for the implementation of import, domestic and export programs that the Agency administers.

- Enables regulatory cooperation and stakeholder engagement: CFIA works with stakeholders, including other government departments and trading partners, to support alignment of regulatory requirements and policy positions.

- Supports market access: CFIA actively participates and leads technical discussions in trade negotiations to facilitate market access for Canadian food, animal and plant products.

Outcomes

Program Delivery

- Provides front-line inspection and audit functions;

- Collects samples for surveillance and marketplace monitoring;

- Conducts quality assurance and monitoring of programs;

- Issues import, export and domestic permissions;

- Carries out enforcement activities on non-compliance;

- Undertakes incident and emergency response

- Assesses and provides feedback to program to inform regulatory and program re-design.

Scientific Expertise and Laboratory Supports

- Provides scientific advice to support sound regulatory decisions;

- Provides risk assessment, risk intelligence and foresight;

- Provides laboratory services in support of program design and delivery;

- Conducts regulatory research and method development;

- Develops surveys and robust surveillance programs;

- Establishes biocontainment standards for labs and oversight of pathogen import programs

- Strengthens the Agency's role as a credible and reliable global science leader.

International Trade

- Works in partnership with AAFC, Global Affairs Canada, and other departments to negotiate and implement free trade agreements;

- Actively participates in international standards setting bodies and works with like-minded countries to set priorities and develop international standards;

- Negotiates and implements import requirements and certifies export requirements for food, animal and plant products within the parameters of our international trade obligations and international standards

- Manages foreign audits and missions related to sanitary and phytosanitary controls.

CFIA Food Incident Response Process

Overview

All food sold in Canada, whether domestic or imported, must comply with Canada's federal Acts and regulations, be safe to eat and not be misrepresented.

When there is reason to believe that food is unsafe or does not follow federal regulations, the CFIA initiates a 5 step process to investigate and determine if a food recall is necessary

Recall definition and classes

A food recall is the removal of a food from further sale or use, or the correction of its label, at any point in the supply chain as a risk mitigation action.

Recalls are classified by risk:

- Class 1: High risk for serious health problems or death (Food Recall Warning usually issued)

- Class 2: Moderate risk for short-term or non-life threatening health problems (Food Recall Warning may be issued)

- Class 3: Low risk for health problems (Food Recall Warning rarely issued)

All recalls are posted by the CFIA on the Government's Recalls and Safety Alerts website.

Food safety investigation and recall process

- Trigger: Starts a food safety investigation (e.g. complaint, CFIA inspection activities, surveillance sample, company-initiated action)

- Food Safety Investigation: To confirm the hazard and extent of the problem; identify the root cause; and collect information for a risk assessment

- Risk Assessment: Determines the level of health risk posed by the product. Conducted either by Health Canada (HC) or within CFIA if a HC policy/guideline exists

- Recall Process: CFIA determines if recall required and issues a recall warning where necessary. Recalling firm is responsible for conducting the recall. CFIA verifies the recall was effective

- Follow-up: CFIA works with the regulated party to ensure that any problems that led to the recall are resolved as well as with industry sectors or foreign countries to address broader incidents that go beyond one recalling firm or sector

Canada's Food Safety Partners

Description for Canada's Food Safety Partners

- Municipal, provincial and territorial agencies

- Primary health responsibility; monitoring outbreaks, interventions

- Canadian Food Inspection Agency (CFIA)

- Regulatory compliance and enforcement; food safety investigations; risk assessment; recall warnings; effectiveness checks

- Health Canada

- Develops health policies and standards; conducts health risk assessments

- Public Health Agency of Canada (PHAC)

- Monitoring outbreaks, interventions; investigations related to human health; laboratory tests, coordination and communication

- Industry

- Implements food safety control investigations; initiates/responds to recalls

- International Partners

- Information exchange

The majority of food recalls are conducted by companies on a voluntary basis, either of their own volition or at the request of the CFIA

If a company refuses to conduct a recall, the Minister of Health can order a mandatory recall under Section 19 of the CFIA Act, where an order is served on the responsible firm. It can also be served on distributors and/or retailers.

There have only been seven mandatory recalls since the creation of the Agency; the last one being in 2004 for nitrofurans in Labonté brand natural honey

On average, each year:

- The CFIA conducts 2,848 food safety investigations

- There are 164 food recall incidents, which may lead to additional (secondary) recalls

Recent priority voluntary food recalls

Infant formula recalled due to Cronobacter sakazakii (March 2023)

- Class 2 recall triggered by the company, who voluntarily recalled product in both Canada and the US

- No reported illnesses

- The CFIA has verified that industry removed recalled products from the marketplace

Caffeinated energy drinks recalled due to various non-compliances relating to caffeine content and labelling requirements (July 2023)

- Class 2 voluntary recalls triggered by the CFIA's inspection activities

- Food safety investigation is ongoing and additional recalls may occur

Potato Wart (PW)

PW is a regulated pest in Canada and regulated by most of our trading partners including the United States, Thailand and Europe.

PW resting spores are persistent in soil and can remain viable for 40 years. They attach to potato tubers rendering them unmarketable.

There are no effective chemical controls or other methods to eradicate PW once a field is infected. Long-term phytosanitary controls are required to prevent spread.

Risk Management Documents. During engagement with industry, three specific areas required more in-depth analysis and consultation: planting of seed, category C&D fields and biosecurity.

Pathways

- The movement of seed potatoes, soil and farm equipment from infected fields to new agricultural locations

- Natural dispersal is very limited, but resting spores can be moved through wind and water erosion to neighbouring fields

- The disposal of potato waste and wash water used during the packing and processing of potatoes

PEI potato acreage by County

- Prince (62%)

- Queens (22%)

- Kings (16%)

Source: Statistics Canada (2016)

Improved Mitigation

- Increased use of potato varieties resistant to PW

- New sampling protocols (tare soil, cull piles) to enhance early detection

- New laboratory methods to confirm and increase testing sensitivity

- On-island soil survey to determine pest free status of non-restricted areas

- Enhanced biosecurity to prevent spread from restricted areas and processing plants

Consultation Timelines 2023-2024

April 2023

- CFIA-Industry working group: Recommendations to CFIA

September 2023

- Enhanced biosecurity and traceability standard discussion

- PEI Potato wart survey

Fall 2023

- Risk Management Document consultation (60 days)

- Criteria for Pest Free Places of Production for Industry

Spring 2024

- National PW Response Plan Consultation (60 days)

- International market discussions with objectives to improve PEI commodity access

Summer 2024

- National PW Response Plan Implementation

End State Program Objectives

- Surveillance

- Biosecurity

- Traceability

- Land registry

- Places of Pest Free Production

CFIA and AAFC Responsibilities in International Trade

Context

The Government of Canada is a signatory to international agreements that confer rights and obligations, including in areas within the CFIA's and AAFC's remit.

AAFC Role

- Leads on negotiations of Agriculture chapters and elements of World Trade Organization (WTO), Free Trade Agreements (FTAs) and new regional/bilateral FTAs

- Engages with partners and institutions, multilaterally and bilaterally, to address trade issues and to collaborate in areas of common interests (e.g. science, environment)

- Advances and resolves market access issues via a Single Window to manage industry requests and coordinate the Federal Market Access Team (AAFC, CFIA and GAC) to advance Canada's trade interests internationally through a whole of government approach

- Offers and provides programs and services (Canada Brand, Canadian Pavilion Program, Agri-Marketing, Agri-Trade Commissioner Service) to promote Canada as a supplier of choice

CFIA Role

- Leads engagement at International standard setting bodies (World Organization for Animal Health, CODEX (International food standards, codes and guidelines), International Plant Protection Convention) to influence the development of policy and promote the adoption of science based standards and guidelines to facilitate trade

- Co-leads with GAC, the negotiation of the Sanitary and Phytosanitary (SPS) chapters of bilateral FTAs to protect food safety, plant and animal health while facilitating trade

- Advocates for open, science based trade to maintain and protect food security, plant and animal health in Canada and globally

- Negotiates and certifies the import and export requirements for trade in plant, animal, food (including seafood/fish and wood products) with Foreign Competent Authorities

Partnerships

Federal

- Market Development, Trade: GAC

- Food Security: HC, Crown-Indigenous Relations and Northern Affairs Canada (CIRNAC), PHAC, Employment and Social Development Canada (ESDC), GAC, ECCC

- Supply chains: Transport Canada (TC), Innovation, Science and Economic Development Canada (ISED)

- Regulatory system: ECCC, Treasury Board of Canada Secretariat (TBS), PHAC, HC, Pest Management Advisory Council (PMAC)

- Seafood and aquaculture: DFO

Provinces and Territories

- Federal Provincial Agriculture Trade Policy Committee, Federal Provincial Market Development Council

Sector Stakeholders

- Cross sector (e.g. Canadian Federation of Agriculture, Canadian Agri Food Trade Alliance)

- National sector (e.g. Canadian Cattle Association, Canola Council of Canada, Canadian Meat Council, etc.)

Top Exports in 2022

- Forestry products and logs Section Note *: $25.5B

- Cereals: $13.1B

- Oilseeds: $10.5B

- Meat and offal: $9.3B

- Cereal preparations (flour, starch, etc.): $7.9B

- Edible vegetables: $7.7B

Top Imports in 2022

- Forestry products and logs Section Note *: $5.2B

- Beverages and spirits: $8.6B

- Edible fruits and nuts: $7.3B

- Cereal preparations (flour, starch, etc.): $5.2B

- Edible Vegetables: $4.8B

- Misc edible preparations: $4.7B

Key Trade Issues

United States

- Canada-United States-Mexico Agreement (CUSMA) dairy Tariff Rate Quotas (TRQ) dispute

- Voluntary Product of USA

- California Proposition 12, Farm Animal Confinement

- Potato Wart/PEI

China

- Atypical BSE

- Decrees 248/249 (CIFER) registration

- HPAI pet food

- Ongoing delays for approval of establishments and products

European Union

- EU Green Deal/Farm to Fork Strategy (F2F), and the EU focus on sustainable production and environment

- Non tariff barriers to trade (e. g. Regulations on pesticides, veterinary medicines, labelling, meat, and deforestation free supply chains)

In 2022, agri-food and seafood exports exceeded $92 billion, a 12.6% increase from 2021.

Top 5 Agri-food and Seafood Export Markets in 2022

- USA: $54.7B (59%)

- China: $9.5B (10.3%)

- Japan: $5.3B (5.8%)

- EU: $4.4B (4.8%)

- Mexico: $2.9B (3.2%)

Top 5 Agri-food and Seafood Import Markets in 2022

- USA: $36.4B (54.2%)

- EU: $7.4B (11%)

- Mexico: $3.8B (5.7%)

- China: $2.3B (3.5%)

- Brazil: $1.4B (2.2%)

Other Programs of Interest

2024 Review of the Safe Food for Canadians Act (SFCA)

Background

The SFCA came into force January 2019.

The Act set out a framework for an outcomes-based regulatory regime that allowed for the consolidation of 14 sets of commodity specific regulations into a single regulatory framework to improve consistency and reduce administrative burden.

Review

The Act requires the government to review the Act five years after coming into force and every five years after that.

Review of the SFCA must:

- Examine the provisions and operation of the Act

- Assess resources allocated to administration and enforcement

The Minister must table a report on the SFCA review no more than 15 days after receiving the report.

Objectives for the review

- Outreach and engage early and often with Canadians, industry and other stakeholders for their perspectives, to help shape the review

- Clarify any specific provisions that are difficult to interpret and update as needed, such as fines for offences

- Identify areas for adjustment, taking into consideration:

- Lessons learned from COVID-19

- Economic growth and market access considerations (e.g. internal trade)

- Need to support innovation (e.g. regulatory experimentation, e-commerce)

- Assess whether:

- Existing funding models, including user fees, adequately support implementation of the Act, and if new funding models are needed

- Legislative changes are required

- The outcome-based approach is understood by inspectors and industry

Critical path

- Early engagement with stakeholders in Fall 2023 to inform the review scope

- Roundtable sessions

- Public opinion research

- Leverage existing fora (industry's Agile Regulations Table)

- Launch SFCA review (Jan 2024)

- Conduct review and draft report (Jan 2024 – Jan 2025)

- Obtain approvals and table report in Parliament (Summer 2025)

- Develop Memorandum to Cabinet if needed

- Introduction of legislative changes in response to review

Considerations

- Engage Minister of Health on proposal framework for review (December 2023).

- SFCA is a new Act and implementation was conducted in phases based on commodity starting in 2019.

- SFCA provides enabling authorities, while the Safe Food for Canadians Regulations (SFCR) support the Act's implementation

- The legislated review was delayed due to COVID-19.

- The review will identify any gaps/mismatch between the Act's provisions and the regulations. For any gaps, there may be recommendations for changes to the Act or suggestions for future regulatory changes for the agency to consider.

Bovine Spongiform Encephalopathy (BSE) Program Renewal

Context

- BSE, sometimes referred to as "mad cow disease", is a fatal disease of the nervous system of cattle caused by prion proteins.

- Prions concentrate in certain tissues called Specified Risk Material (SRM).

- There is no treatment or vaccine available.

- Reportable under the Health of Animals Act.

- Animal-to-human disease transmission can occur by consuming beef contaminated with BSE prions - One Health issue.

Market access and trade

- The BSE program enables Canada's beef sector to pursue international exports to high-value markets.

- In 2021-2022, Canada exported almost 50% of all beef produced in Canada, with a value of around $4.5B.

In 2021, Canada achieved "negligible risk" BSE status from the World Organisation for Animal Health (WOAH).

Renewal of BSE program funding

- [Redacted Text]

- For 20 years, the BSE program has operated on five year funding cycles and the current funding expires in March 2024.

- The conversion to the WOAH updated surveillance system to detect BSE occurrences, the prohibition of most mammalian proteins in ruminant feed, and the exclusion of SRMs from the entire food and feed chains, along with the capacity and tools to effectively respond to cases of BSE-infected animals, remain key elements of the BSE program and are essential for maintaining the negligible BSE risk status of Canada.

- By upholding such a robust program, it not only ensures the safety of the food supply and safeguards the health of both the public and animals by mitigating preventable risks, but also plays a pivotal role in preserving and expanding market access for Canadian cattle beef, beef products and by products.

Longer-term approach

- The need to maintain appropriate, effective BSE surveillance will be an ongoing requirement.

- The BSE program is being redesigned to consider revised WOAH surveillance standards, available science, and stakeholder feedback (e.g. SRM handling and disposal).

- Given the long-term need for BSE programs, the CFIA plans to prepare a business case for permanent program funding in a future budget cycle.

- CFIA will work with stakeholders, other government departments and international partners to ensure BSE risks are considered and public health, animal health and food safety are protected.

BSE program

Expected program outcomes

- Protecting Canada's people and animals from preventable health risks

- Ensuring food safety

- Maintaining and expanding market access for Canadian cattle, beef and beef products

Program objectives

The science-based elements of Canada's BSE program involve:

- Implementing specific risk mitigation measures to prevent the risk of recycling BSE agents within the cattle population.

- Protect consumers from associated human health risks.

- Maintain access to international markets as well as confidence in the Canadian food supply.

Program tools

- Preventing cattle exposure to SRM and ruminant-derived protein meal.

- Conducting ongoing awareness and training for BSE prevention.

- Monitoring and enforcing feed ban and SRM controls.

- Ongoing implementation of a BSE program, including traceability.

- Protocols for managing cases of BSE and cattle affected by atypical BSE.

Canadian Shellfish Sanitation Program (CSSP)

Context

The CSSP is a long-standing interdepartmental federal food safety program that aims to minimize food safety risks from molluscan shellfish (e.g. mussels, oysters and clams) and maintain domestic and international trade.

- Canadian Food Inspection Agency (CFIA): Program lead; marine biotoxin surveillance

- Environment and Climate Change Canada (ECCC): water quality surveillance

- Fisheries and Oceans Canada (DFO): harvest site access/use

Drivers

- The CSSP faces increasing pressures from Indigenous groups, commercial industry and other stakeholders to maintain current service delivery, and expand services to additional geographical areas to support economic growth.

- However, the program has not received new funding for over 20 years, and with increased program costs and inflation, the CSSP is challenged to deliver services as designed.

Current initiatives

2022 DFO-led Horizontal Evaluation of the CSSP and resulting Management Action Plan (MAP)

- A 2022 CSSP horizontal evaluation report recommended: clarifying program priorities, scope and reach; improving program governance and clarifying CSSP leadership to improve decision making processes; addressing resource gaps; and updating performance measures.

- Led by DFO, the MAP is in development including a full program modernization analysis and review of the program's raison-d'être, priorities, scope and reach; engagement with Indigenous Peoples and other key stakeholders; and a legal opinion on CSSP partner authorities.

Immediate challenges

Harvest site closures and the program's inability to accept expansion requests

- Long standing program integrity issues have resulted in harvest site closures, and inability to expand services, which has a significant economic and social impact on Indigenous Peoples and regional economies:

- Reconciliation with Indigenous Peoples is a top priority, however, the inability to deliver CSSP services in certain areas is seen as constituting infringement on Indigenous Food, Social and Ceremonial (FSC) harvest access rights.

- Commercial shellfish industry sees the CSSP as a barrier to trade and economic development due to the inability to re-open closed sites or expand service delivery.

Atlantic harvest site closures and declassification

- [Redacted Text]

- Compounding the issue, recent July floods in Nova Scotia resulted in the temporary closure of most harvest sites due to the risk of shellfish contamination posed by the flood waters.

Key Milestones

- Explore all funding options

- Engage Indigenous Peoples and key stakeholders

- [Redacted Text]

- Examine the CSSP raison-d'être, priorities and scope, do a full cost-benefit and options analysis, and make recommendations on a modernized CSSP

In progress

- [Redacted Text]

- Implementing the Management Action Plan to respond to the 2022 CSSP Horizontal Evaluation:

- Completed analysis of existing program demands and pressures; [Redacted Text]; continuing efforts to secure additional program funding.

Next steps

Immediate

- [Redacted Text] complete and independent review of the CSSP, and provide recommendations for a modernized program.

- [Redacted Text]

- Apply lessons learned for future program vision.

Longer term

- Develop CSSP future state based on program review recommendations, [Redacted Text].

Considerations

- [Redacted Text]

Interprovincial Trade Pilot Projects

Context

Assessing longer-term solutions that support food safety and market access domestically and internationally

- November 2021: FPT Agriculture Ministers direct officials to develop pilot(s) to address unique interprovincial food trade challenges in remote border communities, such as Lloydminster.

- July 2022: FPT Ministers welcomed updates on four proposed pilots. FPT Ministers supported the guiding principles for the pilots.

Guiding principles

- Maintain public confidence in Canada's food safety systems

- Do not compromise Canada's market access abroad or international reputation

- Maintain international obligations for like treatment of imported and domestic food

- Recognize the outcome basis of the Safe Food for Canadians Regulations (SFCR) as enabler for the pilots

- Apply lessons learned

Considerations

- Challenges to interprovincial trade go beyond regulatory requirements and include access to capital, business case to expand, supply chain interdependencies, need for technical support, and regulatory differences between jurisdictions.

- Some of these are economic and business challenges; others require close FPT collaboration to understand, work through, and resolve.

Next steps

- Advance the Lloydminster regulatory amendment – Canada Gazette in Fall 2023

- Move forward on the "Ready to Grow" pilot, informed by the Journey Mapping Exercise, to work with specific establishments seeking an opportunity and support to grow – Summer 2023

- Once a business is confirmed, launch the Ontario-Quebec slaughter availability pilot – Summer 2023

- Continue to study opportunities for and challenges of interprovincial trade in Canada:

- Industry engagement – drivers for increasing interprovincial trade

- Environmental scanning – inter-state trade in US (Cooperative Interstate Shipment [CIS] program)

Lloydminster Pilot

January 2023 – Alberta and Saskatchewan launch pilot project to ease food trade challenges within the city of Lloydminster. CFIA posts a Notice of Intent to amend the SFCR for a long-term solution.

Ready to Grow Pilot (high volume provincially regulated meat businesses)

March 2023 - AAFC, CFIA and Ontario conducted a regulatory journey mapping exercise with Ontario meat businesses and provincial and national associations to inform development of a pilot to test market opportunities in other Canadian provinces or territories; providing insight on market demand, operational differences, and supply chain dependencies.

Slaughter Availability Pilots in Border Regions

Currently exploring inspection models and flexibility of outcome-based standards:

- Ontario and Quebec have identified a provincial abattoir and are assessing feasibility for pilot participation.

- Ontario and Manitoba considering targeted engagement to identify and understand unique challenges to examine through a pilot.

Hot issues

Review of Canada's BSE List of Specified Risk Materials

Context

Bovine spongiform encephalopathy (BSE), or "mad cow disease", is a serious neurological condition caused by prion proteins that affect cattle. Prions concentrate in tissues called specified risk material (SRM Section Note 1). Animal-to-human disease transmission can occur by consuming beef contaminated with BSE prions – One Health issue.

Issue

The cattle industry has requested that the CFIA review the BSE list of SRM for the purposes of harmonising with the United States' list of cattle material prohibited from animal feed (CMPAF Section Note 2). Country differences place the Canadian cattle-processing sector at an economic disadvantage to U.S. counterparts ($31M per year). The CFIA is providing financial and scientific expertise towards the completion of a risk analysis to better understand the consequences that may arise from harmonization, including human and animal health, as well as international trade. The risk analysis will form the foundation for future policy and regulatory reviews and possible changes.

Specified Risk Material

Description for Specified Risk Material

A scientific diagram with body parts that can harbour Specified Risk Material (SRM). The body parts that the graphic features using a colour-coding system are:

- Skull

- Brain

- Eyes

- Tonsils

- Trigeminal Ganglia

- Dorsal Root Ganglia

- Vertebral Column

- Spinal Cord

- Distail Ileum (portion of Small Intestine)

Canada and U.S.

Ratio of Materials

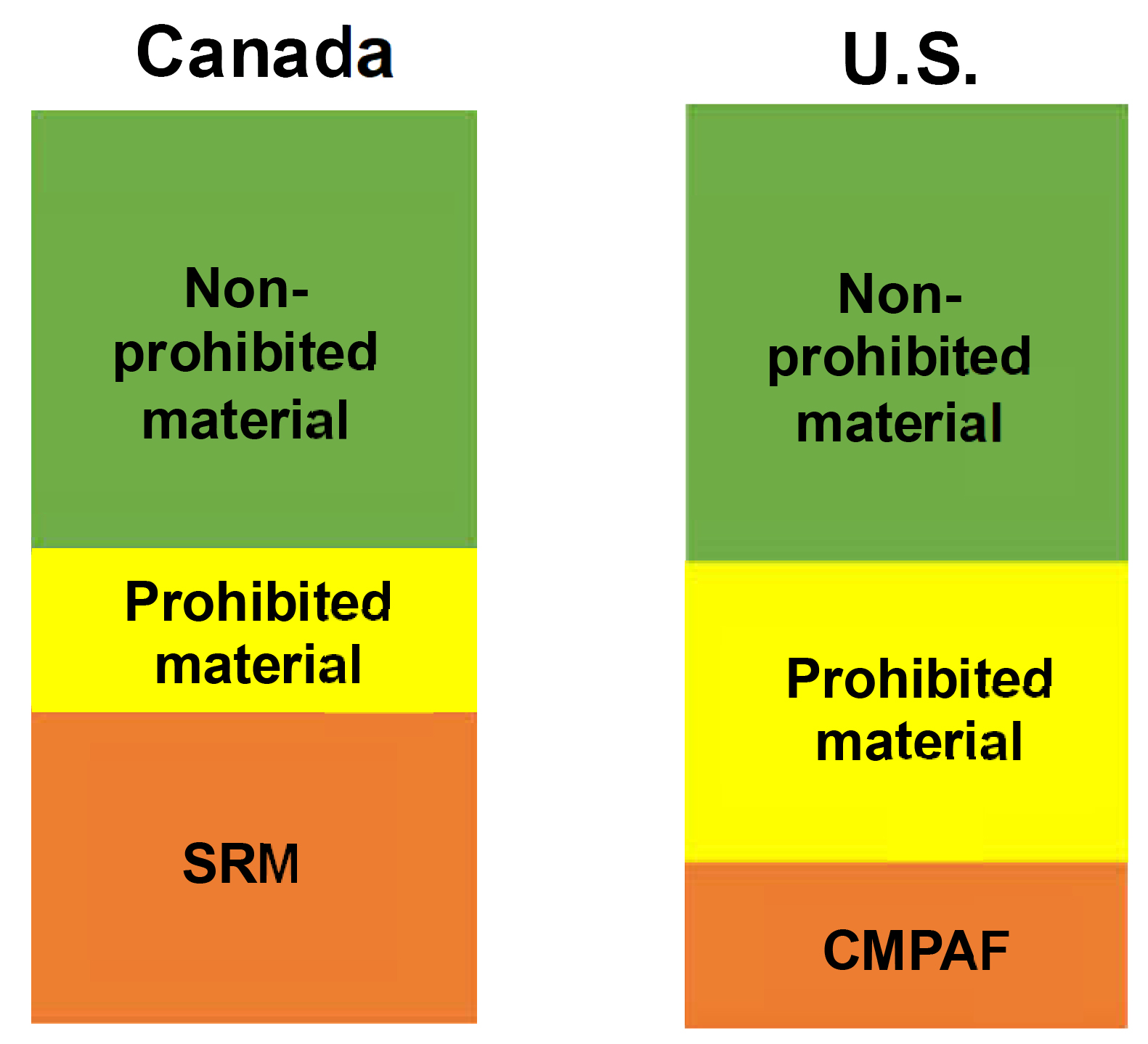

Description for Ratio of Materials

Visual comparison featuring the ratio of materials found in Canada and the U.S. Materials are listed as: non-prohibited material, prohibited material, SRM (in Canada)/CMPAF (in the U.S.).

The two countries have about the same amount of non-prohibited material; whereas the U.S. has more prohibited material, and Canada has more SRM.

Non-prohibited material is material that can be fed to ruminants Section Note 3 in U.S and Canada.

- Prohibited material can not be fed to ruminants but can be fed to non-ruminants in U.S and Canada. Prohibited material is mammalian proteins, except those derived from porcines or equines, as well as milk, blood, gelatin and their products, and ruminant-derived fats with maximum 0.15% of insoluble impurities.

SRM and CMPAF represent material that can not be fed to any animal. Canada's SRM includes a greater volume of animal materials than U.S. CMPAF, which results in less value per head.

Review process

- Risk Analysis

- International Assessment

- Policy Decision and Regulatory Changes

Benefits and Impacts

Canadian feed ban harmonizes with the U.S.

- Increased cattle processing revenues

- Expected U.S. recognition of negligible risk status

- Possible increase in prohibited material / meat and bone meal (MBM) revenues

- Possible loss of market access

- Lower revenues for companies transporting and disposing of SRM

Mitigation Measures and Timelines

- Risk analysis: 2022-2023 to Fall 2023

- Risk analysis consultation: Fall 2023 to Winter 2023

- International peer review: mid-Fall 2023 to mid-2024

- Policy analysis and consultation: mid-Fall 2023 to end of 2024

- Developing regulatory changes: end of 2024 to end of 2025

- Canada Gazette, Part I: end of 2025

African Swine Fever (ASF) Overview

Context

ASF is a viral disease that only impacts pigs. As it spreads around the globe, it poses a significant risk to the health of the Canadian swine her, the pork industry, and the Canadian economy.

CFIA received funding ($3 million over three years) for the Government of Canada to work with stakeholders to test roles and responsibilities and identity gaps ahead of an ASF outbreak.

Drivers

In support of ASF preparedness, two areas of focus for CFIA are:

- Simulation exercises: Increase readiness by validating ASF preparedness plans and testing response capabilities through exercises involving all stakeholders.

- Zoning (Regionalization): To contain the disease to part (or parts) of Canada to support eradication of the disease, and to return Canada to an ASF-free disease status.

Simulation exercises

CFIA is working closely with Animal Health Canada (AHC), AAFC and other stakeholders to plan multiple exercises over the next two years.

Tentative pre-drill, tabletop and simulation exercises will review:

- Permitting, surveillance and tracing (pre-drills)

- Information flow, roles and responsibilities, depopulation and disposal, cleaning and disinfection, and surveillance (large scale deployment exercise)

- Regional response structures, HR allocation, animal welfare, border closures (large scale tabletop exercise)

- Notification, public communication and zoning following initial detection (senior management tabletop exercise)

Zoning

Apply lessons learned from avian influenza

CFIA is continually evaluating lessons learned from the ongoing Avian Influenza response to refine requirements and procedures regarding control zones and related surveillance.

Develop movement risk mitigation plan

ASF Executive Management Board Movement Control Working Group is developing recommendations for voluntary movement controls to be implemented by industry before control zones are established.

Negotiate new zoning arrangements

Currently, Canada has ASF zoning agreements with the USA, EU, Singapore, Vietnam and Hong Kong.

CFIA is actively exploring further zoning arrangements based on market priorities, feasibility and opportunities (e.g., Japan, South Korea, and United Kingdom).

Recent ASF exercises

- May 2023: AAFC test of surplus hog depopulation and disposal with FPT Deputy Ministers (DMs) and senior industry representation.

- • June 2022: CFIA test of roles and responsibilities for CFIA Senior Management Committee (SMC) and the National Emergency Operations Centre (NEOC) during an ASF event.

- May 2022: CFIA/AAFC test of unified communications plans.

Japan

An ASF zoning arrangement is high priority for both CFIA and Industry given the volume of exports to Japan.

It would significantly contribute to mitigating the consequences and supporting recovery from a detections of ASF in Canada.

Japan has raised concerns regarding Canada's wild pig surveillance.

CFIA continues to work with Japan's Ministry of Agriculture, Food and Forestry (MAFF) to respond to and resolve these concerns.

Next steps

- Ongoing: Continued international negotiations on zoning agreements

- Fall/Winter 2023: CFIA led table top exercises

- 2024: AHC led pre-drill, in person response simulation and table top exercises

Canada's Foot and Mouth Disease (FMD) Vaccine Bank

Context

About foot-and-mouth disease (FMD)

- Severe, highly contagious viral disease, affecting most cloven-hoofed animals (e.g. cattle, pigs, sheep, elk).

- Reportable under the Health of Animals Act.

Currently

- Canada has FMD-free status (last detected in 1952).

- In an outbreak, control and eradication of FMD are achieved by "stamping out" the disease. FMD incidence is increasing worldwide.

- Surge in global demand for vaccines.

- International modeling shows vaccination reduces duration and spread of large outbreaks by half.

Objective

A ready supply of FMD emergency vaccines to support Canada's emergency response efforts and strengthen Canada's ability to respond to an uncontrolled FMD outbreak(s) more effectively.

Budget 2023

Establish a FMD Vaccine Bank for Canada and Develop FMD Response Plans

- Announced $57.5M over five years and $5.6M ongoing.

- In addition to the existing supply of FMD vaccine through the North American FMD Vaccine Bank.

- Federal government to seek cost-sharing arrangement with provinces and territories to establish the Bank and develop response plans.

Guiding principles

- Optimize the benefit for Canada: all provinces and territories benefit from coordinated, rapid response, no matter where FMD occurs (objective: to target animal populations at greatest risk).

- Proportional contribution: reflect provincial/territorial capacity, number of animals and species distribution.

- Support sector resiliency: protect market access/trade and industry viability (estimated $19.4B to $65.2B potential FMD impact on economy).

- Support ongoing risk-prevention activities: vaccines help manage outbreaks; proactive prevention is key in disease management.

- Collaborate across sectors: leverage regional strengths and diversity for effective response; respect shared FPT jurisdiction over agriculture.

- Remain forward looking/innovative: build Canada's capacity to ensure ongoing access to vaccines, including exploring domestic production.

FPT engagement

Effective collaboration

- FPT Ministers of Agriculture endorsed the guiding principles in July 2023.

- The Ministers supported:

- a strong governance structure to advance FPT negotiations, with technical support from the Council of Chief Veterinary Officers (CCVO);

- the need to jointly engage with Animal Health Canada to advance response-planning work with industry.

Progress to date

Request for information was issued to seek input on Canadian biomanufacturing capacity to support the creation of the bank and to inform development of a Request for Proposals (to be issued in fall 2023).

Looking ahead

Next Steps

Create federal negotiating strategy on the potential features and parameters of cost sharing the vaccine bank.

Highly Pathogenic Avian Influenza (HPAI) 2022 Response

Context

H5N1 virus was first detected in wild birds in Newfoundland in December 2021, and across the eastern seaboard by January 2022.

As of August 2023

- HPAI has been detected at 322 infected premises (IPs) across nine provinces with the last case detected in early May 2023.

- 310 IPs have been released, and 8 active IPs remain: (Saskatchewan (3), Alberta (4), British Columbia (1).

- Compensation payments to affected owners total approximately $135 million.

- Approximately 7.6 million birds have been impacted.

Opportunities

- Early detection and agile response

- FPT and stakeholder engagement – Readiness

- One Health approach

- Communication and information sharing

- Recovery and Lessons learned

Considerations

Partnerships

- Response support by Federal, Provincial, Territorial (FPT), and Industry partners

- Mapping stakeholders roles and responsibilities

- Technical information sharing (Google Drive)

Transparency

- Timely communication and information sharing with industry, provinces and public

- International reporting (trade)

Science and risk based response

- Early detection in provincial laboratories to respond faster

- Advanced scientific analysis and support in National Centre for Foreign Animal Diseases (WOAH AI reference lab)

- Risk based response in line with internationally accepted practices

Resource pressures

- The size and extent of this response placed tremendous pressure on fiscal and human resources

- The CFIA is a respected and trusted guardian for trade, animal health and food safety

Outcomes

- Enhanced FPT and Industry capacity to prevent and respond to HPAI based on each province readiness

- Increased surveillance in domestic and wild birds to inform biosecurity

- Risk communicated to stakeholders

- Adopted a risk based approach to control the disease with balanced impacts on core mandate and stakeholders

- Invested in resources and CO2 storage to support timely depopulation

- Supported continued market access

- Supported public health in monitoring this virus and viral changes of concern

Next steps

- Complete lessons learned exercise from 2022 experience in consultation with provinces and territories and industry

- [Redacted Text]

- Continue international engagement to address guidance and trade issues

Oak Wilt

- Oak wilt is a regulated pest for Canada

- Oak wilt infection blocks the flow of water and nutrients, leading to death of Oak trees

- Infects all oak trees, but red oak species are more affected than white oak species. No effective treatment

- Unknown origin and first reported in the U.S. more than a century ago; has since spread to 24 U.S. states. Very low spread.

- Detected for the first time in Canada in June 2023, in southern Ontario

Introduction pathways

- Short distance: vectored by bark and sap beetles and through interconnected roots

- Long distance: infested oak material with bark attached

Oak Wilt (U.S.)

Description for Oak Wilt (U.S.)

A map of oak wilt distribution by county and state in the United States shows how close oak wilt is to the Canadian border.

New York, Michigan, Pennsylvania and Ohio are some of the US states that are infested with oak wilt and close to Ontario, Canada.

Possible impacted sectors (anticipated losses if widespread)

Urban trees and ecosystem services will be impacted if Oak Wilt were to establish.

- Oak lumber/logs exports: $76 million (2022)

- Urban trees: $350 million in cost for street tree removal and replacement

- Standing timber: $112 million value losses

- Ecosystem services: $41 million each year

Impacts on CFIA

- Delimitation activities (visual inspection, sampling)

- Response and implementation (notices, movement control)

- Stakeholder Communications

- No impact expected on export certification

Mitigation Measures and Timelines 2023

Oak wilt program

- May to December

- D-99-03: Phytosanitary import requirements to prevent the entry of oak wilt disease from the continental United States, plus the Oak Wilt Response Framework for Canada prepared with partners

Prevention

- May to December

- Prevention includes surveillance (national survey and external protocol), communication and awareness with partners, oak wilt pest cards, import inspections, oak wilt program for import of logs from the US.

Outreach and engagement

- June

- Notification to partners and stakeholders at the local, provincial, national and international level, including industry

- June to December

- Outreach with stakeholders, partners and international colleagues (ex. FPT, OGDs, NGOs, Technical Advisory Committee [TAC], the city of Niagara, Windsor, Sarnia and London, United States, United Kingdom)

Response to oak wilt detection

- May

- PAE (Potentially Actionable Event) initiated

- June

- Sampling and lab analysis (Confirmed detection in Niagara Falls (Ontario))

- June

- Evaluation of management options (Incident Command Structure [ICS] implemented, including any further positive sites in Ontario)

- June

- Eradication: destruction of dead trees in Niagara Falls (Confirmed detection in Barrie (Ontario))

- June to October

- Eradication: delimitation of infested zone and control on oak trees inside the infested zone in Niagara Falls and Barrie and survey of oak trees within 1.6 km (Confirmed detection in Niagara-on-the-Lake (Ontario))

- October to December

- Destruction of oak trees in infested zones detected in 2023

Oak wilt Technical Advisory Committee (TAC)

- June

- First TAC meeting

Oak wilt Technical Advisory Committee

- June

- Second TAC meeting

- June to December

- TAC meetings as required, with regular frequency established to support response

Box Tree Moth (BTM)

- BTM is a regulated pest for Canada (2022).

- Causes severe defoliation of boxwood when pest populations are high. Well adapted to environment in Southern Ontario.

- Feeds only on boxwood which are ornamental shrubs. No native hosts.

- Native to Asia and first reported in Canada in fall 2018. Currently established in Ontario from east of Toronto to Windsor (2022). Breeding population detected in Quebec in August 2023.

Introduction pathways

- Boxwood nursery stock

- Natural dispersal (up to 10 km per year) and potentially further when supported by wind

Box tree moth 2022 survey results for Ontario

Description for Box tree moth 2022 survey results for Ontario

The map shows the locations of box tree moth traps and scouting sites placed in southern Ontario in 2022, extending from Windsor to Ottawa.

Negative sites shown with green dots extending the entire area surveyed.

Positive sites shown with red dots, box tree moth detections are concentrated in the Greater Toronto Area and in the Niagara region. Isolated populations were detected adjacent to Lake Ontario in: Clarington, Guelph, Halton Region, King Township, Pelham Township, Simcoe County, Wainfleet Township and Essex County.

Box tree moth 2022 survey results for Canada (BC, ON, QC, NB)

Description for Box tree moth 2022 survey results for Canada (BC, ON, QC, NB)

The map shows the locations of box tree moth traps placed across Canada in 2022. There are 203 traps in Ontario, 15 traps in Quebec, 3 traps in New Brunswick, and 162 traps in British Columbia.

In Ontario, negative sites shown with green dots extending the entire area surveyed, in southern Ontario, extending from Windsor to Ottawa.

Positive sites shown with red dots, box tree moth detections are concentrated in the Greater Toronto Area and in the Niagara region. Isolated populations were detected adjacent to Lake Ontario in: Clarington, Guelph, Halton Region, King Township, Pelham Township, Simcoe County, Wainfleet Township and Essex County.

In British Columbia, there are 162 negative traps shown with green dots.

In Quebec, there are 15 negative traps shown with green dots.

In New Brunswick, there are 3 negative traps shown with green dots.

Impacts

Industry

- Nursery Stock: Top 5 nursery product for sales Estimated Annual value (2020 - $40 million)

- Trade: Seeking to regain U.S. Market Access (since May 2021)

- Treatment: Seeking new registered treatments for nursery and homeowner use

CFIA Resources

- Surveillance activities outside of Ontario following movement of infested nursery stock

- Communications social media and public outreach

- Engagement with United States Department of Agriculture

- Competing priorities for inspection resources - Export, import and domestic activities

- Community Science Surveillance

Mitigation Measures and Timelines 2023

BTM Program Development

- January

- Consultation on BTM Directive (D22-04)

- February

- Finalize Directive

- May

- Publication of D22-04

- June

- Program (D22-04) implementation

- July

- Ministerial Order to support enforcement

- August to December

- Program review for effectiveness

Prevention

- April to December

- Includes community science focused surveillance, communication and awareness, import inspections, implementation of D-22-04 – domestic inspections

Outreach and Engagement

- January to December

- Includes stakeholders, FPT partners and the public

Responding to detections

- June

- Detection at retailers east of Ontario

- July to September

- Ongoing response to reports / detections outside of Ontario

Eradication treatments access

- May to July

- Emergency use registration extension granted for DeltaGard insecticide June 26

- July to August

- Pest Management Regulatory Agency (PMRA) comment period for proposed registration decision for DeltaGard

Formal US-Canada BTM bilateral working group

- June

- First formal meeting

- September

- Formal meeting

- December

- Formal meeting

BTM Technical Advisory Committee (Ontario and industry)

- January-December

- TAC meeting every 3 weeks since 2019

Spotted Lantern Fly (SLF)

- SLF is a regulated pest for Canada (2018).

- Sap feeding invasive insect that causes direct and indirect damage to plants and trees.

- Feeds on a wide variety of plants: grape vines, trees, nursery stock.

- SLF is native to Asia, and was introduced in the US in 2014. Since then, the SLF has spread to 14 US states, but is not yet detected in Canada.

Introduction Pathway

- Plant commodities (e.g. nursery stock, forestry products)

- Non-plant (e.g. shipping containers, vehicles and equipment, pipe, stone, tile)

Areas at risk

Description for Areas at risk

A map of Canada, highlighting the areas at risk for spotted lanternfly establishment and impact the location of counties, which include the interior of British Columbia, southern Ontario and southern Quebec and the southern portions of New Brunswick and Nova Scotia.

Impacts

Industry

- Wine and Grape: Greatest anticipated impact from SLF. Industry contributes $11.6 billion to Canadian economy

- Maple Syrup: $430 million in exports (Canada is the largest exporter)

- Fruit (other than grape:) $1 billion

- Ornamental Nurseries: $747.5 million

- Movement of forestry products between the U.S. and Canada: $300 million annually

CFIA Resources

- Response and Implementation

- Delimitation activities (visual inspection, issue notices, movement control)

- Staff Mobility (detection may result in deployment of staff from other regions)

- Re-prioritization of resources may lead to under delivery of some activities

- Detection in more than one location in short timeframe

Mitigation Measures and Timelines 2023

SLF Program Development

- January to March

- Risk Management Document (RMD) Consultation

- May to August

- RMD decision

- September to December

- Directive development and consultation

- December

- Program implementation

Prevention

- January to December

- Includes surveillance, communication and awareness, import inspections

Outreach and engagement

- January to December

- Includes to stakeholders, partners and international colleagues (e.g. FPT, OGDs, NGOs, Technical Advisory Committee (TAC) working groups), United States and other countries with native and introduced SLF populations) and the public

Responding to detections

- May to December

- As detections of live SLF (all life forms) occur, response plan will be implemented

Eradication treatments access

- January to March

- Minor use registration (MUR) applications for Danitol and Kopa insecticides on fruit crops submitted to PMRA by Provinces

- March to May

- Emergency use registration (EUR) application submitted for Altus insecticide on ornamentals

- June to July

- EUR granted for Altus June 23

- July to August

- MUR granted for Kopa and Danitol

Formal US-Canada SLF bilateral working group

- May

- First formal meeting

- June

- Formal meeting

- September

- Formal meeting

- December

- Formal meeting

SLF Technical Advisory Committee (FPT and industry)

- February

- TAC meeting

- May

- TAC meeting

- November

- TAC meeting